Imagine a new brand launching in a hyper-competitive market. Its competitors have been grinding away for a couple of years and have hundreds of millions of dollars in venture capital in the bank.

This new brand decides not to raise any money from those investors.

That sounds like a pretty tough situation to be in, right?

But Purple, the brand in question, is thriving in a market that has become even more cut-throat.

In this article, I will show you how their unlikely story played out. And how they leveraged Google Ads to accomplish this.

Prefer the video version?

Table of Contents

Purple?

Purple sells mattresses.

The company launched back in 2015 with a $171,000 Kickstarter campaign. In the years following the did more crowdfunding campaigns to launch new products like their pillow and pet bed.

So while they raised some money with crowdfunding, they never took any VC investment.

Without external investments, they had to fund all of their growth from their revenue.

That’s a huge difference compared to a brand like Casper Mattresses which has raised $240M. Other direct-to-consumer mattress brands like Leesa have raised $32M.

If you compare those brands, they all look pretty similar:

- Sell direct-to-consumer

- Lower prices vs offline

- Free & convenient shipping

- 100-night trial

- Similar product

All of the above characteristics are also true for Purple, which started 2 years after a lot of their competitors.

One advantage that gave them was all the money Casper had spent on making consumers comfortable with buying a mattress online.

But even then, Purple still had to find a way to sell mattresses.

They had two options:

- Do the same than their competitors but try to do it better

- Do something different

As we’ll see later, doing #1 required a ton of cash which they didn’t have.

So Purple picked #2 and doubled down on video and branding right from the start.

Here is the video that accompanied that first Kickstarter campaign:

This is not business as usual 😊

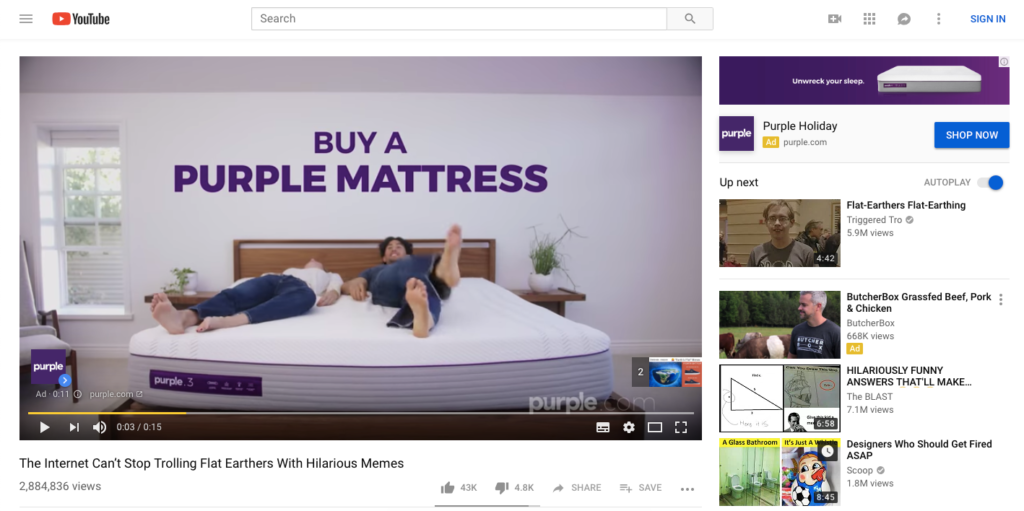

Not only do they have these great videos, but they also push them really hard via YouTube ads.

There have been only a couple of brands that have done YouTube right, and Purple is definitely one of them.

Before continuing I want to give a huge shout-out to Bryant Garvin! He is the former VP of ads of Purple. I’ve learned a ton from his articles, Twitter, podcast appearances and presentations. Thanks a lot Bryant!

Purple Google Ads Overview

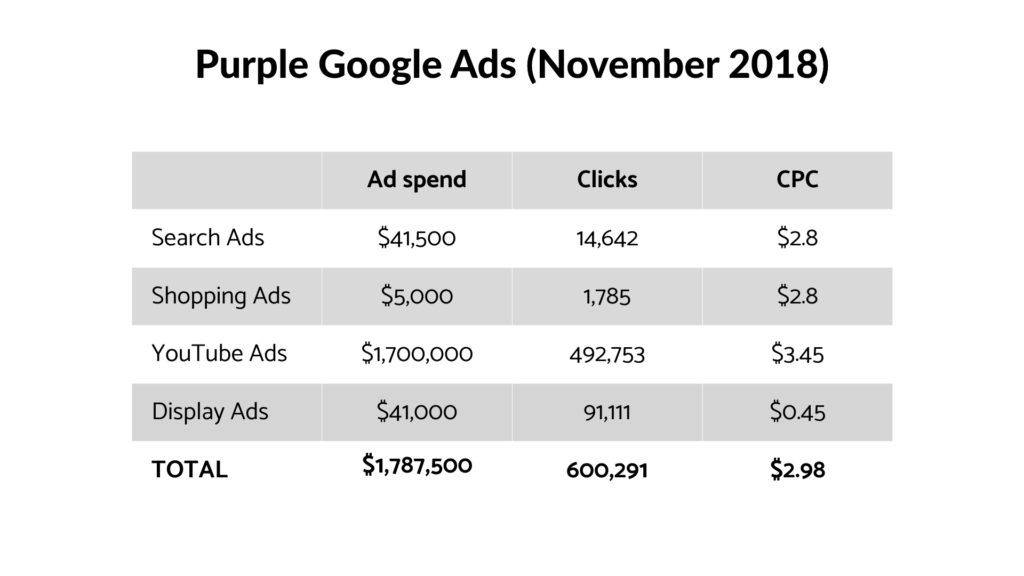

Here is the overview of the Purple’s Google Ads budget:

This is only the second episode in this series, but this section always takes a lot longer than I expect. That’s because this research decides the whole story.

To create this profile on Purple Mattresses I made MANY assumptions, so please bear with me 😅

Purple will do $405M in revenue in 2018 and has slotted 143M in “Marketing and selling” expenses. (I got this information from investor documents they used when selling the company early 2018)

They do almost everything in-house. Here is a quote from CMO Alex McArthur:

“We have more people on our creative team than our advertising or acquisition team. We cannot get enough good creative.”

So let’s say 50% of their $143M marketing spend is actual media budget, and a third of that amount is spent on Google Ads. (I found a breakdown of their video views on Facebook vs YouTube which I use as the spending breakdown for the media budget as well)

That works out to a total budget of $1,787,500/month.

In one interview, I found former VP of ads Bryant Garvin confirming they can spend up to $50-100k on some days. That puts our budget estimate in the right ballpark.

How It All Started

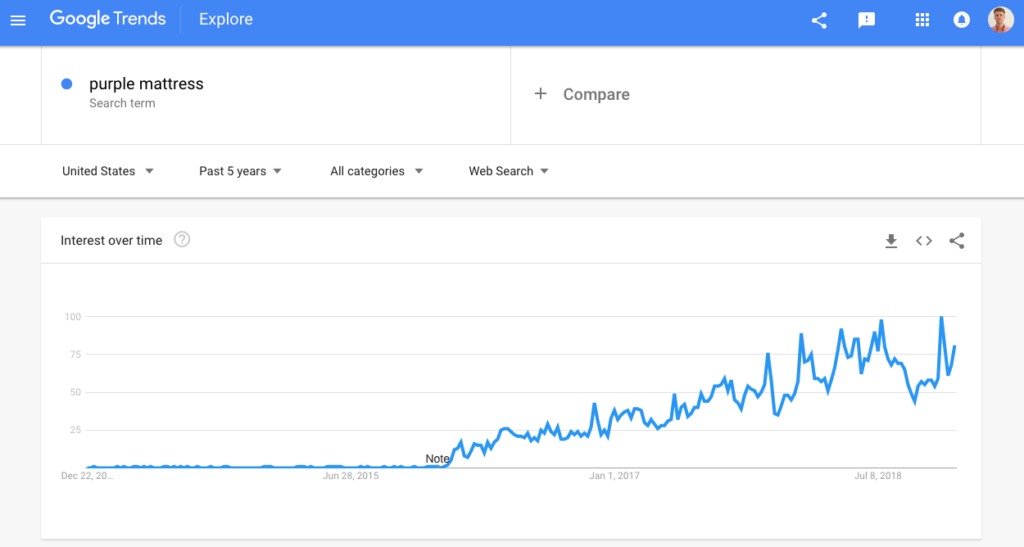

“Purple mattress” didn’t exist as a search term before 2016, and today it drives most of their sales.

So how did they get people to start searching for it?

Here is how..

ƒnm

Purple YouTube Ads

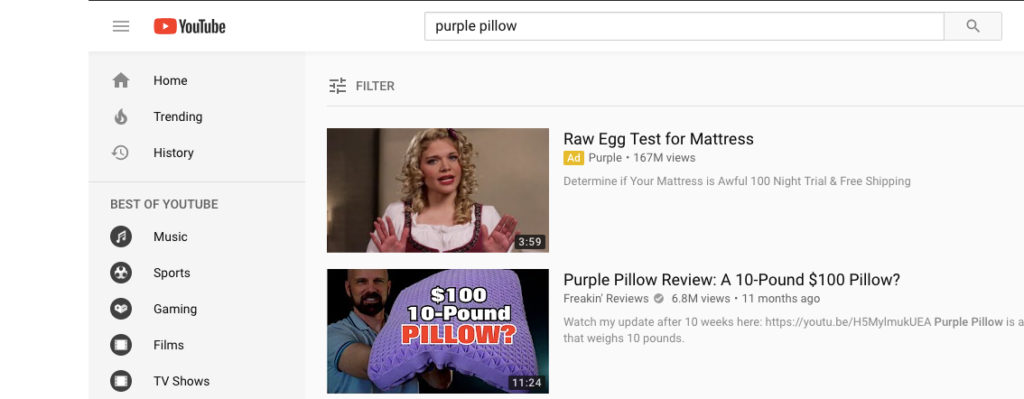

Video is at the cornerstone of what makes Purple tick. Here is the most popular YouTube video with 167M views:

A look at their YouTube channel reveals that their videos have been viewed 627,095,519 times. Purple self-reported a figure in early 2018 that they’ve had hit a billion video views on their ads across Facebook and YouTube.

Here is their broad strategy:

- Create great and memorable ads to brand “Purple = good mattress” into people’s mind.

- Then when the moment comes people actually need to buy a mattress, they will think of Purple.

Video views on YouTube are a lot cheaper than clicks on Google Search Ads (more on that later). But it’s still a risky investment. That’s because there is a lag between someone seeing an ad and the actual purchase. Few people will see the ad on YouTube and buy a $1,000 mattress right after.

That makes attributing a sale to that YouTube ad pretty hard.

Luckily for Purple, things were pretty simple when they started out.

Back then, they were only running video ads, so any lift in sales was 100% attributable to those early campaigns. Comparing dollars in vs dollars out gave them the confidence that this was the right strategy to pursue.

Even today, attribution remains hard. Garvin, said that if they saw a direct ROAS of 1.5 on the YouTube campaigns, they knew that the actual ROAS would climb to 4 by looking at a 30-60 days period.

Besides watching sales come in, they also had other indicators that looked promising.

Google has a research survey called Brand Lift which is an experiment that divides the audience you want to target into two. One half will see your ads while the other half doesn’t. Then afterward, they look at the difference in branded search queries between the two groups.

Here are the results Purple found when they ran such a campaign:

- People that watched >30 seconds (what Google counts as a view): 30x increase in branded searches.

- People that skipped the ad: 6x increase in branded search queries.

These numbers are pretty huge. And the group that skipped the ads still showed a considerable increase, which Purple got for free, because you don’t pay for skipped ads on YouTube.

Let’s dig a little bit deeper into their YouTube campaigns.

Types of YouTube campaigns

If you’re new to YouTube Ads, it might seem that there is only a single type of campaign: show ads before or in the middle of a video. But there are actually six types of YouTube Ads.

Here are the ones that I spotted for Purple:

- In-stream Ads – the regular skippable or not-skippable videos ads

This is the campaign type that spends the majority of the Purple YouTube budget.

- In-search ads – Branded search

YouTube is the world’s second biggest search engine. So when it comes to doing research, many people will search on YouTube.

So to be everywhere, Purple is running ads to branded search queries on YouTube.

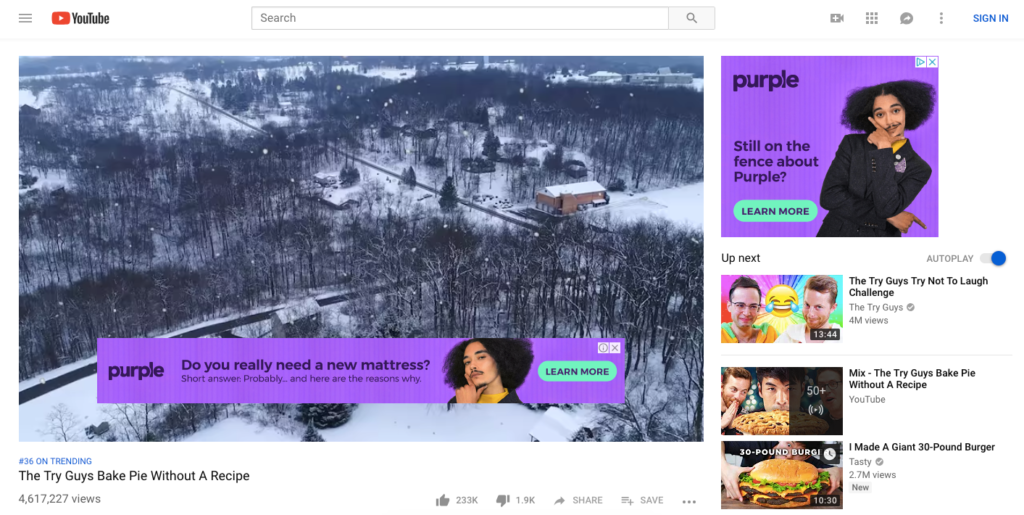

- Display ads: banner ads and overlays with other videos.

Here is what that looks like:

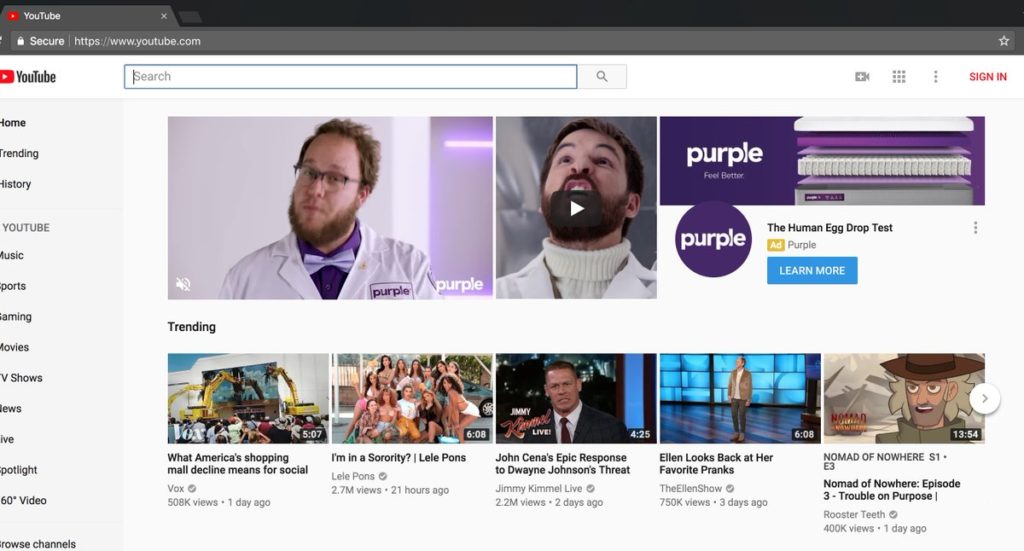

- Youtube Masthead takeover – this placement shows your video, banner, and call to action on YouTube homepage for 24 hours.

This kind of placement is the big leagues when it comes to online brand awareness advertising.

It costs $900,000 a day and reaches a TON of people. (If you don’t have the budget but want to see how it would look for your brand, check out this little tool)

Here is what the Purple YouTube homepage takeover looked like:

YouTube audiences

One of the key ingredients to getting these types of creative campaigns working is to test all of the audience + video ad combos.

YouTube has a ton of targeting options available. Below I’ll go through the ones that I found Purple is using. But with that big of an ad budget, I’m pretty sure they spend a lot of time experimenting with other options.

Targeting option 1: remarketing

This targeting is the one leveraged most heavily by Purple.

If visit their website or see one of their videos, they’re able to retarget you with video or display ads.

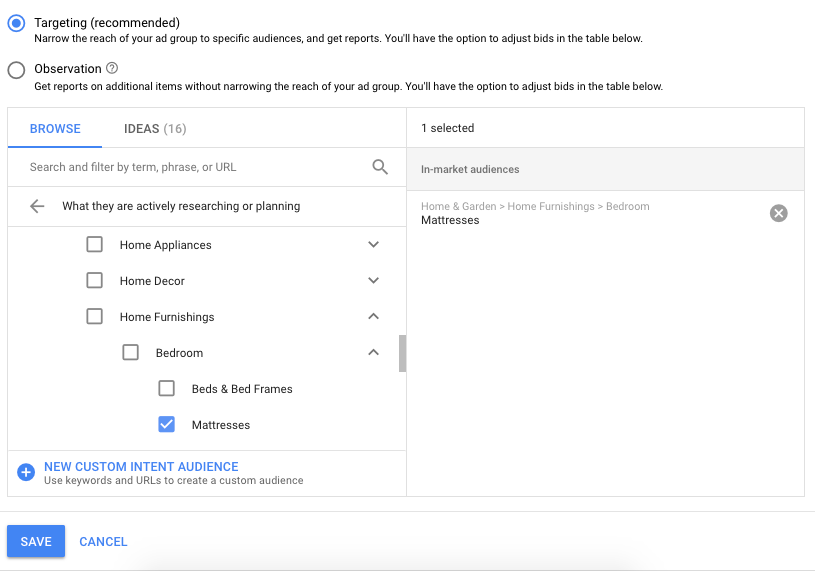

Targeting option 2: In-market audiences

In-market audiences are groups of people that Google categorizes as being in the market for one of almost 500 products.

In the case of Purple, that would be the “Mattresses” and/or “Beds & Bed Frames” markets:

This could be because you visited a site that mentioned mattresses for example.

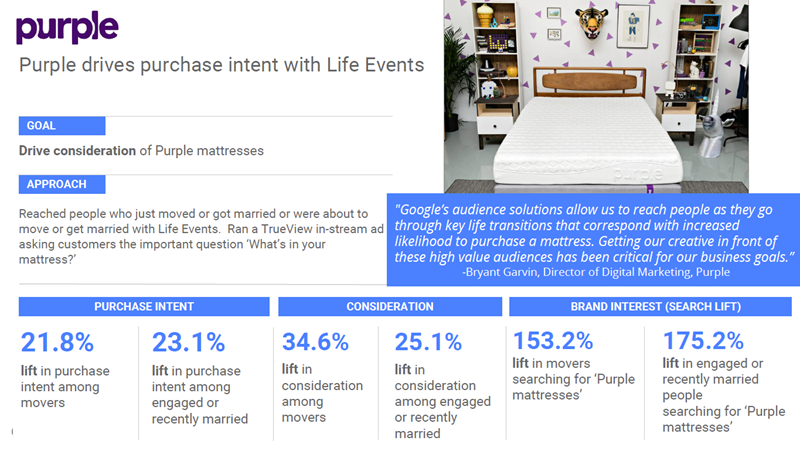

Targeting option 3: Life Events

Life Events are big changes in a person’s life. And Google is pretty good at picking this up from analyzing the signals from its users.

Big changes are usually accompanied by a shift in spending, something that’s very valuable for advertisers like Purple.

Here is a screenshot from a presentation where Google was using Purple as a case study for this “Life Events” targeting:

Purple ran ads to people that recently got married or that recently moved. Here are the results from another Brand Lift study:

- Recently married: 175% lift in searches for “purple”

- Recently moved: 153% lift in searches

That are good results, but it’s a lot lower than the 30x increase in searches I mentioned earlier. (Which was probably one of their more effective campaigns)

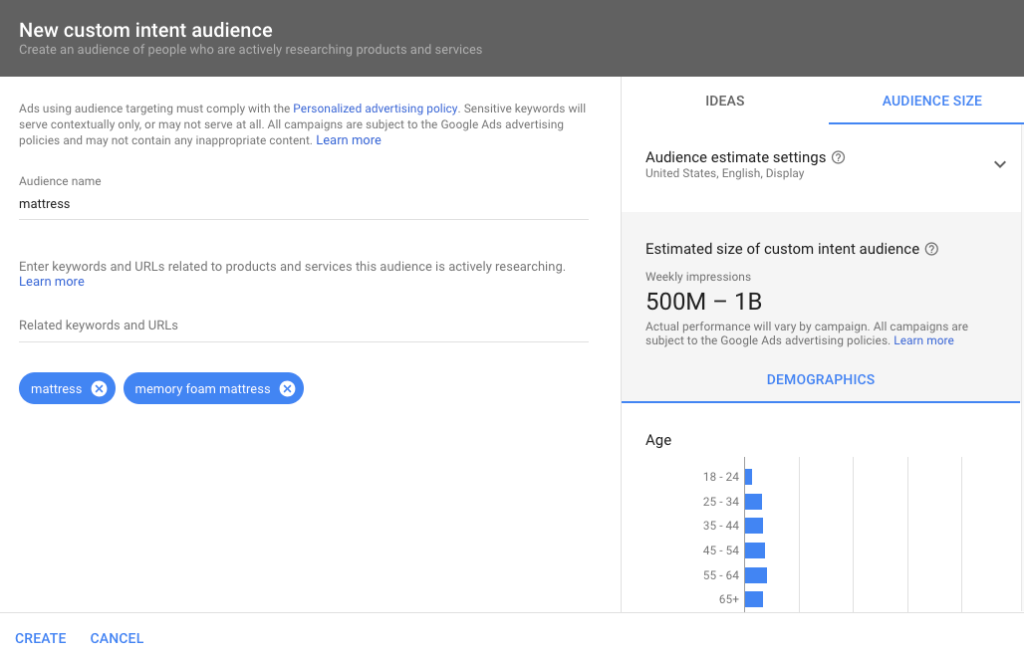

Targeting option 4: Custom intent audience

These custom intent audiences are similar to in-market audiences. The big difference with these is that you can define your own criteria instead of relying on Google’s presets.

You can, for example, select people that search on Google for a “memory foam mattress”. Google cookies these people and allows advertisers like Purple to create custom intent audiences based on that keyword.

Advertising to “mattress searchers” resulted in the following for Purple:

- 37% lower cost per visit

- 340% brand search lift

I’m not exactly sure what these percentages are benchmarked against. But it makes sense that this targeting option works well.

Purple YouTube advertisements

Up until now, I’ve spent a lot of time talking about the technical side of video: budget, campaign types and targeting options.

But all these things are of no importance if the actual videos are bad.

So when Purple was starting out, they wanted to get this part right and aim for the best possible creative they could find.

They turned to Harmon Brothers, a video agency that is responsible for some of the most viral product videos like Squatty Potty:

or Poo Pouri:

Their video productions aren’t cheap. Videos can easily have a price tag of $500,000.

For Purple they created the Goldilocks video:

Following that video, Purple continued producing video ads that are focused on storytelling and emotion.

Stories over facts. But in those stories, they managed to pack in a lot of facts by mixing humor with education.

Apart from having a strong concept and execution, the foundation of success with video ads is testing. And to be able to test well, you need to have this in mind when you’re creating the ads.

So as part of their production process, Purple creates a ton of different combinations for every ad. They test things like opening lines and branding elements. Here is former VP of ads Bryant Garvin talking about it:

All of the ads I’ve shown so far are highly produced ones.

But they mix things up. Here is a no budget customer video that they run as an ad:

This video worked very well for them and has over 67M views!

After testing a ton of different variations of unlisted YouTube videos, they publish the winners to their YouTube channel.

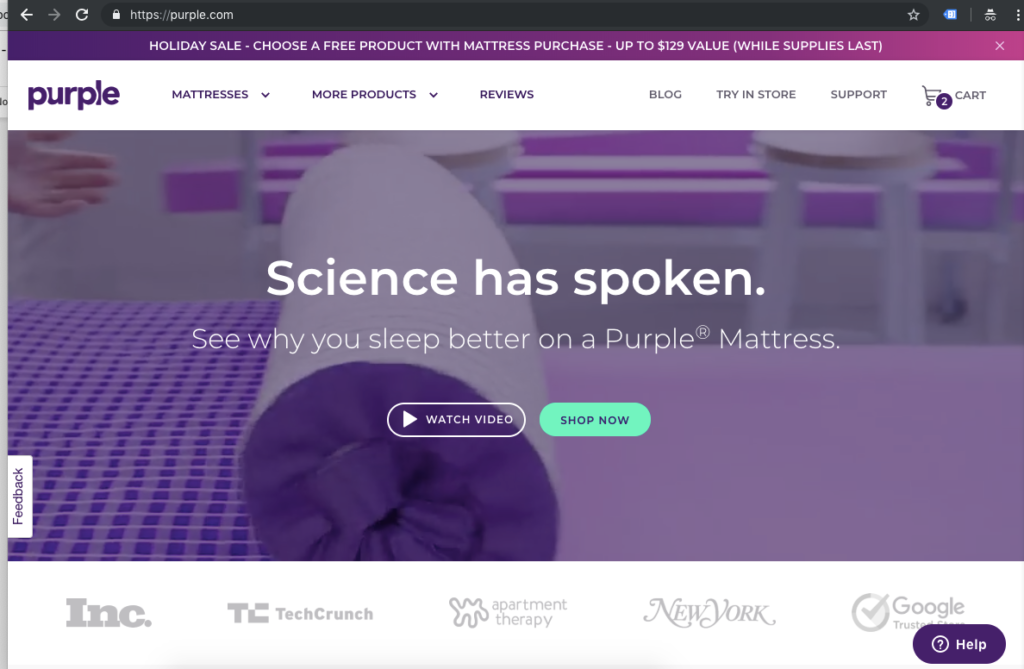

They also use the best ones on their website. Like here on their homepage:

That “Watch video” button opens the YouTube clip in a pop-up window.

So apart from showing ads to people that have visited specific pages on the site, they can show ads to the people that have watched specific videos.

This allows them to do advanced strategies like video ad sequencing, which take people through a funnel.

Purple Search Ads

As mentioned in the overview, Purple spends only a small fraction of its budget on Search ads.

This is because the cost per click in the mattress niche is super high. Relevant non-branded keywords can go all the way to $30-50 per click!

That’s because the cost per click follows the product profit or amount of VC funding.

That brings me back to the challenge I mentioned at the start of this article.

You start 2 years after an extremely well-funded competitor that’s spending heavily on Google Search Ads, paying $30/click and having the system in place to convert that traffic. What do you do?

If you go head to head with them on Google Search you would have to do better than they are.

Which is possible, but you would do just a little better: a little better margin, a slightly higher CTR, a small increase in conversion rate, etc.

And if you’re 2 years behind, you’ll have to make up for the difference in brand awareness.

This approach also requires a ton of cash. It is the strategy that other mattress brands like Tuft & Needle and Saatva are currently pursuing.

Purple avoids most of this by heavily relying on video, but they do run some Search Ads campaigns.

A very rough breakdown of their Search Ads clicks would be 40% branded vs 60% non-branded traffic.

Branded paid search

Here are the top branded keywords for Purple:

In a presentation, Purple said that their branded (non-RLSA) campaigns are responsible for 85% of the impressions and 80% of the clicks on their branded campaigns.

In other words: 80% of people searching for “purple” or related terms have never been on their site.

This is pretty remarkable and shows the brand strength that Purple has established. Because most of these people have discovered Purple through their videos.

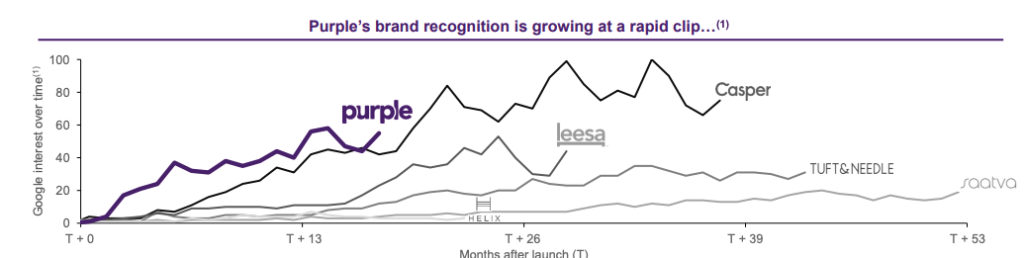

Here is a chart that shows the brand recognition of Purple vs its competitors. You can see that the brand has grown a lot faster than those competitors.

Non-branded paid search

Purple non-branded keywords

Let’s start by looking at looking at a sample of the top non-branded keywords:

From this list, it becomes clear that they aren’t spending much on “mattress” keywords. Only the “king-size mattress” search query pops up in this list.

They do go after keywords of mattress-related products like “mattress protector”, “bed toppers” and “best pillow”.

But the bulk of the list is made up by informational search queries like “best sleeping position” or “sleepings positions”.

On these search queries, Purple shows a content-focused ad:

Which sends people to their ultimate guide on sleeping positions.

The cost per click of this type of searches is a lot lower, $0.25 – $0.5 range, and probably brings them interesting top of the funnel traffic that they can retarget.

Purple Shopping Ads

Purple’s Shopping campaigns have been going through a transition these last couple of months.

When I did the bulk of my research, December 2018, they were pretty much offline. Overall spend was low and even for branded search queries their product listing ads weren’t showing up.

The few ads that I did see were probably RLSA Shopping ads.

But now their campaigns have picked up steam again (with a new team behind the dials).

It seems to me that Purple is aligning its Shopping Ads strategy with that of its Search Ads: maximizing the impact on branded queries.

Purple Display Ads

Purple also heavily uses Display Ads, also known as regular banners.

It’s hard to tell from the outside, but I think a lot of those banners are remarketing, in-line with their core strategy.

Here is an example of such a banner:

Besides these, I found different, less product-focused banners that are probably used to target cold audiences. Like this one targeting hot sleepers:

Purple has also partnered with Disney, to promote its mattresses alongside Disney movies.

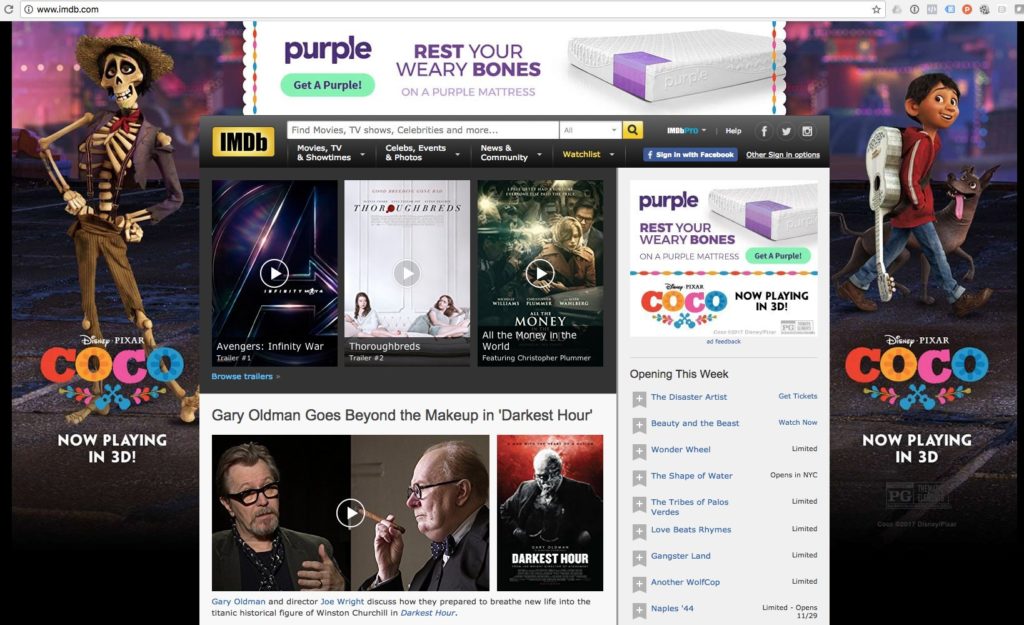

Here is an example from the movie Coco:

Note that this is an unlisted video with 10M views. The Coco video that was published to their YouTube channel only has 3.3M views, and it has a slightly different intro.

Complete with an IMDB takeover:

Another example from a promotion they ran when the movie Wreck it like Ralph came out:

The Purple Scoreboard

The Scoreboard brings together all of the research and analysis and attempts to ballpark Purple’s actual profit numbers.

To simplify calculations, I’m disregarding refunds, upsells and repeat purchases. This model only considers customers purchasing a single product.

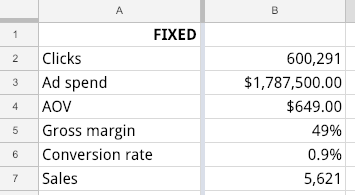

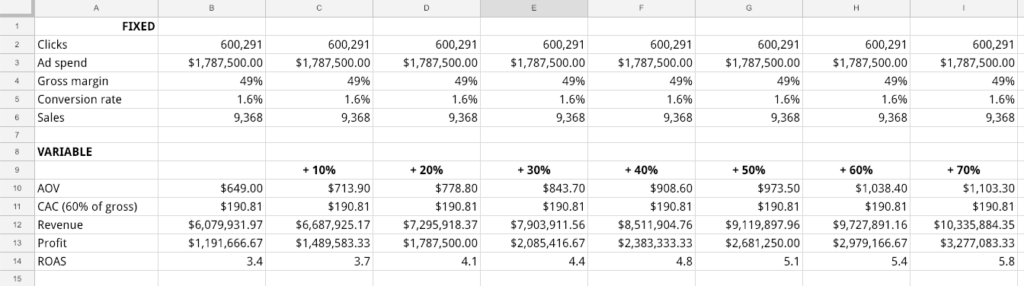

First we start with the numbers from the research:

(If you’re interested in the actual Google Sheet, click here to get it)

From the investor documents I mentioned earlier I found their Cost of Goods Sold to be 51%

The average order value is $649, a conservative estimate which equals their cheapest mattress.

Model 1: No Profits

In this model, Purple is forgoing all profits and spending all of the profit on acquiring more customers.

The customer acquisition cost is equal to the average profit per order, about $318.

It’s pretty unlikely that this is how they are running their business. SO let’s see what happens if we scale down the CAC.

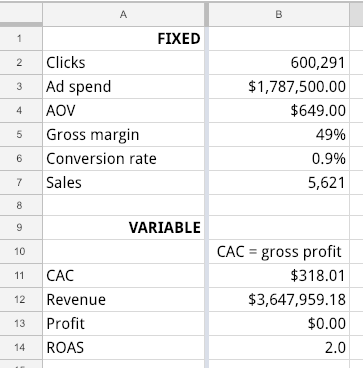

Model 2: Lower CAC

In the left column, all the profit is spent to acquire more customers. More to the right, the CAC scales down.

The numbers start making sense around a CAC of 50-60% of gross profit.

I found more information on a similar mattress company, Eve Sleep, that filed to go public. The numbers are from late 2016, so maybe a little outdated, but they paint a very bleak picture. A conversion rate of 0.6% and a customer acquisition cost that amounts to 55% of the average order value(!).

Because Purple always had to fund its own growth, I’m confident that their profits look a lot better.

Model 3: Higher AOV

Like I said, $649 is their cheapest mattress, their most expensive one starts at $2499, without upsells. So I don’t doubt the actual average order value will be higher.

Note that the “Profit” on that second last row only takes the COGS and advertising expenses into account. So overhead, video production costs, logistics and refunds still need to be removed.

But even then, the numbers in The Scoreboard start to look very good 😎

Takeaways

The Scoreboard confirms that a reasonable customer acquisition cost makes all the difference.

While competitors are outbidding each other in the Search & Shopping Ads, Purple takes a different approach but reaching customers before they start searching in Google.

Purple will definitely feel the crunch of more and more competitors flooding the space. But because of its different marketing strategy, it will feel less of the associated customer acquisition cost increase.

This makes all the difference in such a competitive space.

That’s it for Purple Mattresses!

I would love to hear your feedback and suggestions in the comments. If you have a brand in mind that you want this see this kind of analysis of, let me know!

Read our other breakdowns: MVMT – Judy – Away – Allbirds – Glossier – Ritual– Caraway – FIGS