In this latest installment of Google Ads Aces, we’re going to take a look at Away.

Away is a US-based direct to consumer ecommerce business that sells travel luggage.

Started in 2015 by two former Warby Parker executives, the company has truly disrupted an industry.

In the short time since its inception, they’ve managed to oust a 100-year-old competitor to become the market leader in the luggage space.

Let’s try to figure out how they accomplished this and what role Google Ads has played and still plays today!

If you prefer a video, I’ve made short recap:

Table of Contents

Away’s Origins

The goal was to bring innovative technology to the design and actual products. Their first product, a carry-on suitcase featured a built-in power bank with USB ports.

They didn’t launch on Kickstarter, but they did something very similar when they found out that their products weren’t going to be ready in time for the 2015 holiday season.

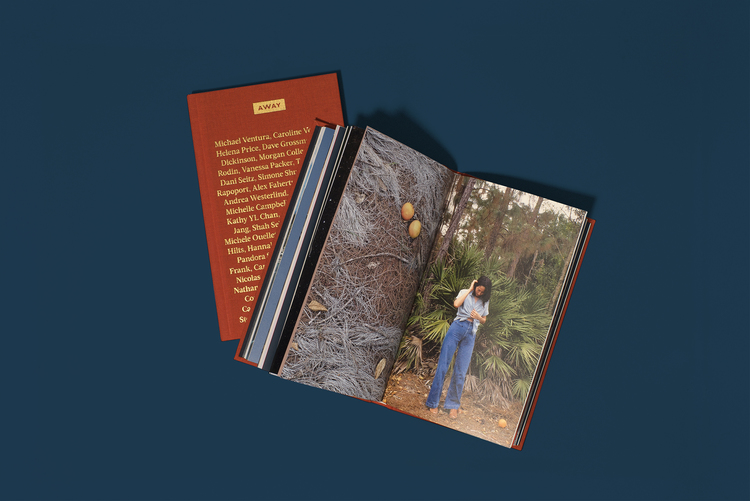

Being unable to sell the actual luggage, they created something else to sell, a book called “The Places We Return To”. It was a collection of travel stories put together by 40 different people, all people with at least some influence.

They sold 1,200 books and each of them included a gift card that was redeemable when the product would launch.

This book did two things: establish the Away as a “travel lifestyle” brand and turn all of those book collaborators into brand ambassadors.

The book isn’t available anymore, but a lot of the same philosophy goes into a print and digital magazine they still publish: Here!

Tearing apart product and brand to evaluate their exact impact isn’t easy. For most companies, they are intertwined.

But in the case of Away, there is another brand that launched at the same time with the same product, Raden, and it offers some comparison. Their trajectories weren’t 100% the same, but Raden focused a lot less on brand and a lot more on the product. This might have contributed to the brand’s demise.

Away’s Business

In their second year of operations, 2016, the company did $12 million in sales.

They turned profitable in 2017 and made $150 million in 2018 selling 500,000 suitcases.

The bulk of their revenue comes from online sales, with some physical stores opening up to reinforce their brand.

The company has raised $181M to date, valuing it at $1.4B. They raised their last round in May 2019 worth $100M, and will use this money to further increase international expansion, opening more physical stores and expand their product portfolio.

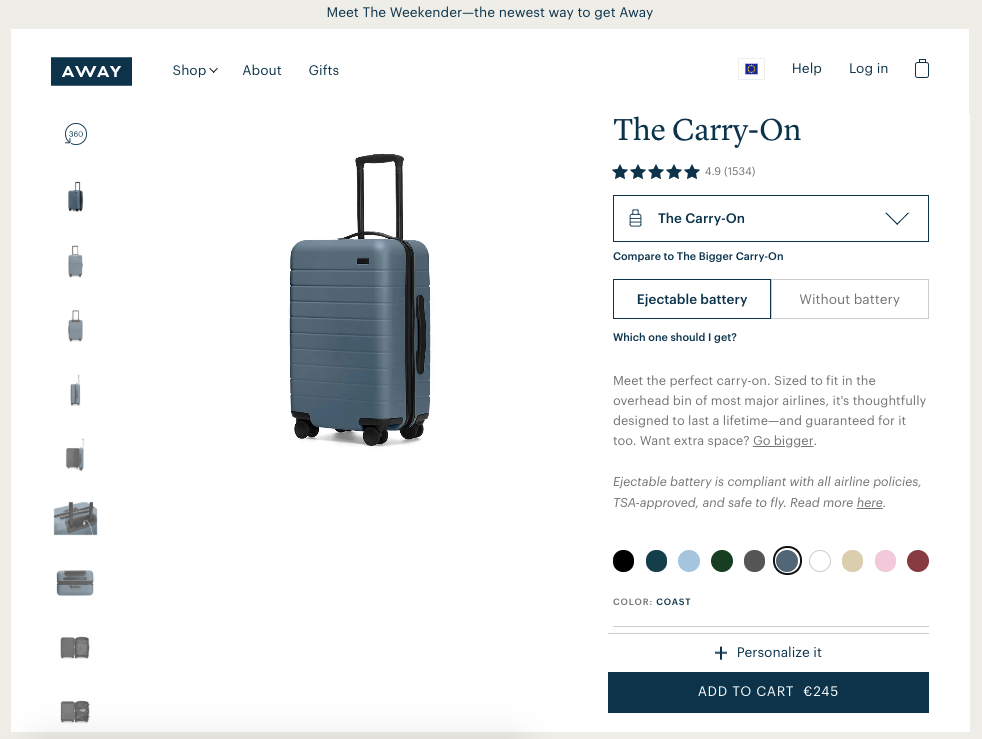

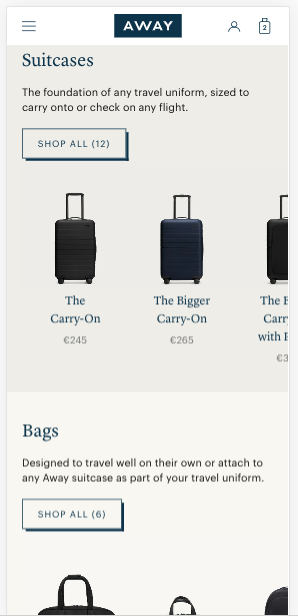

Their most popular product is the Carry-On:

Since most people don’t need a ton of suitcases, they’ve been hard at work to expand their product catalog to be able to sell more to existing customers.

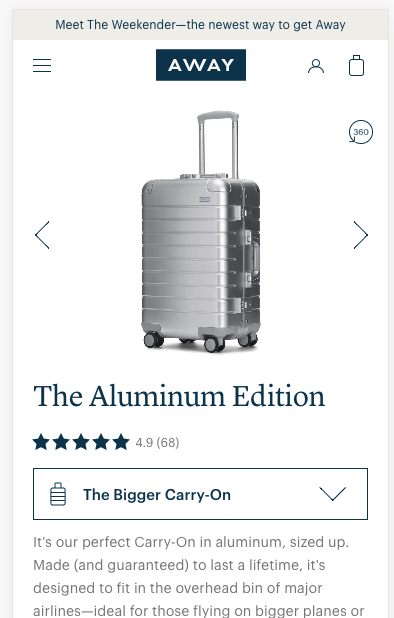

Different colors, sizes, and types of luggage like backpacks and products at higher price points like an aluminum suitcase:

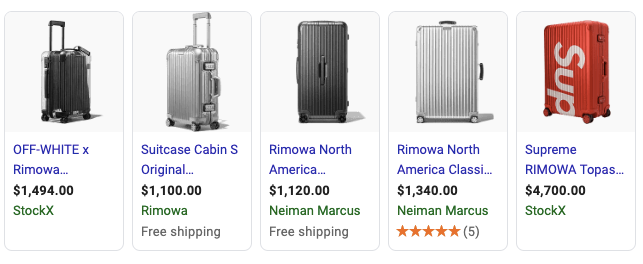

At $495, this aluminum carry-on doubles the price from the regular product. This allows them to compete with more premium brands like Rimowa.

To expand their reach, and create some exclusive collections, they’ve worked with celebrities like Karlie Kloss, Rashida Jones or Dwayne Wade.

The Wade collab led to a special Away carry on that let’s you carry 6 bottles of wines with you:

Weird is good 😎

As we’ve seen with previous installments of this series, having a well-known brand helps keep CAC under wraps.

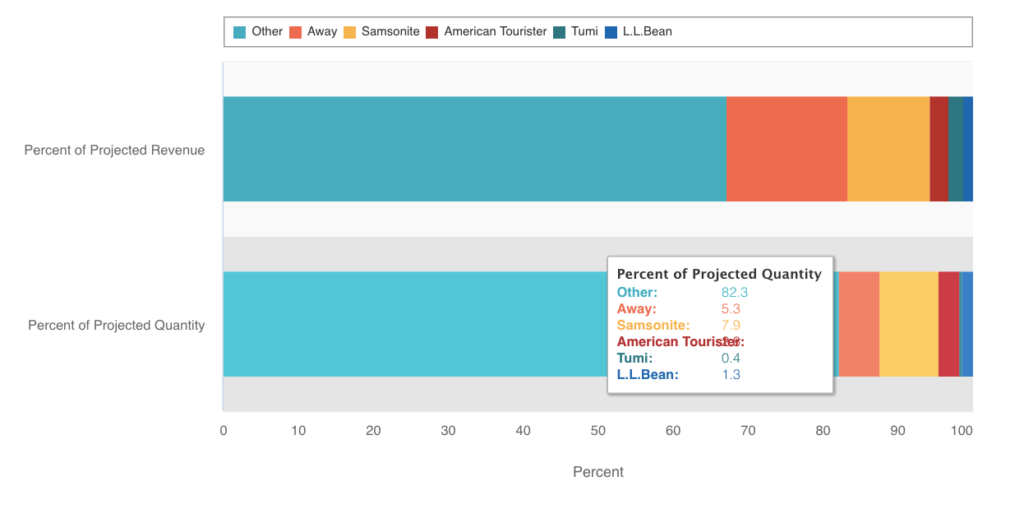

The graph below from research by Rakuten shows that Samsonite has the biggest market share (US) when it comes to units sold, at about 8%. Away is close at 5%.

But the economics of those units look different for both brands. Away can command higher prices sells direct to consumer. Samsonite sells most of its product wholesale.

So if we look at revenue, Away is the market leader with 16%. Samsonite is second at 11%.

This is absolutely mind-blowing. Samsonite has been around for over 100 years while Away was founded less than 4 years ago.

They achieved this market share by building very strong word of mouth (fueled by their own PR efforts), social media and content marketing.

Away Site Analysis

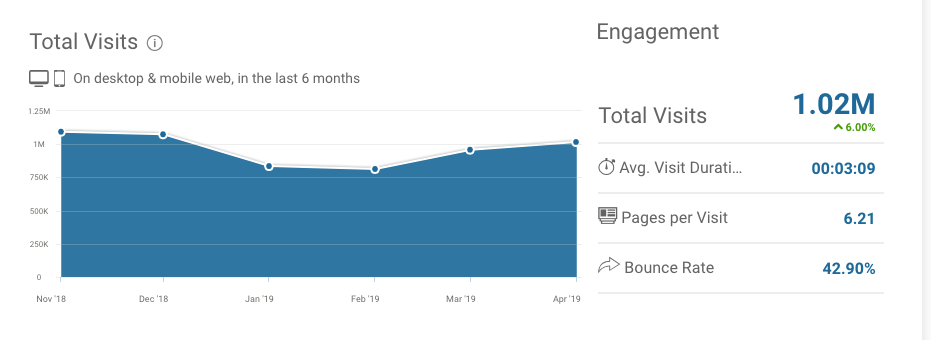

AwayTravel.com is a well-trafficked site. According to Similarweb, it got over a million visits in April 19.

Most of that traffic comes from the US, with the UK and Canada as distant second and third countries.

Search (both organic and paid) accounts for 41% of all visitors, direct for 35%, social is at 16% and about 6% are referrals.

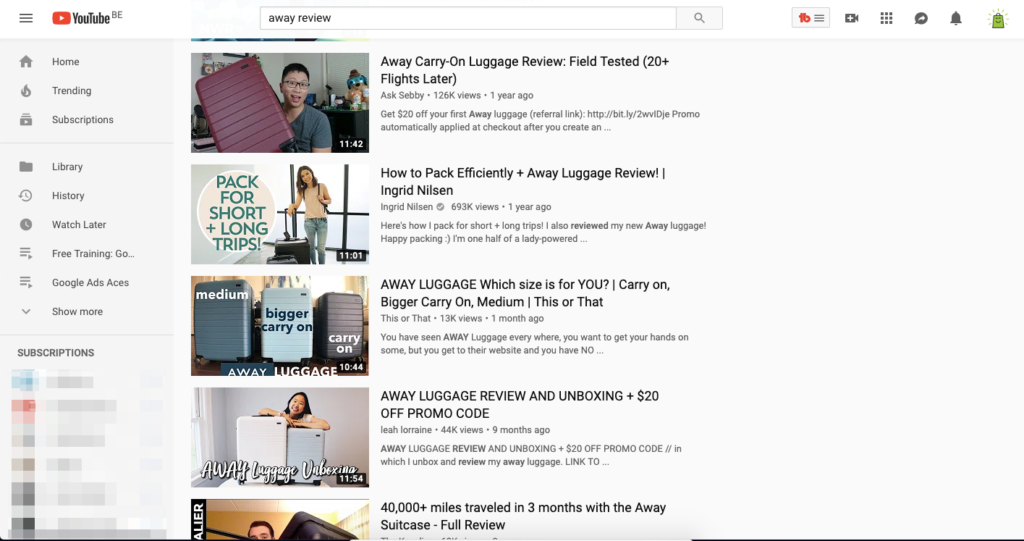

About half of these referrals, about 30,000 visits/mo, come from an affiliate network. This indicates a strong affiliate program, fueled by reviews on YouTube & Instagram.

If we take a closer look at search, about 75% is organic search, and 25% paid search.

So in what follows, we’ll take a closer look at what Away spends to get those 100,000 visits per month, how they spend it and what they can do better!

Away’s Google Ads Campaigns

Estimates for April 2019

| Ad Spend | Clicks | CPC | |

| Search Ads | $58,000 | 50,000 | $1.16 |

| Shopping Ads | $37,500 | 50,000 | $0.75 |

| YouTube Ads | $0 | 0 | $0 |

| Display Ads | $2,160 | 5,800 | $0.45 |

| TOTAL | $97,660 | 105,800 | $0.92 |

As always a little background on these numbers.

Source of these numbers is Semrush, Spyfu, Similarweb and our benchmarks collection.

My calculations:

- Total traffic: 1M / month

- Search traffic: 41% – 400k

- Organic / paid breakdown: 75% – 300k / 25% – 100k

- Search / Shopping breakdown: 50% – 50k / 50% – 50k

Google Search Ads

The 40,000 paid search visitors are split 30/70 when it comes to brand and non-branded search queries.

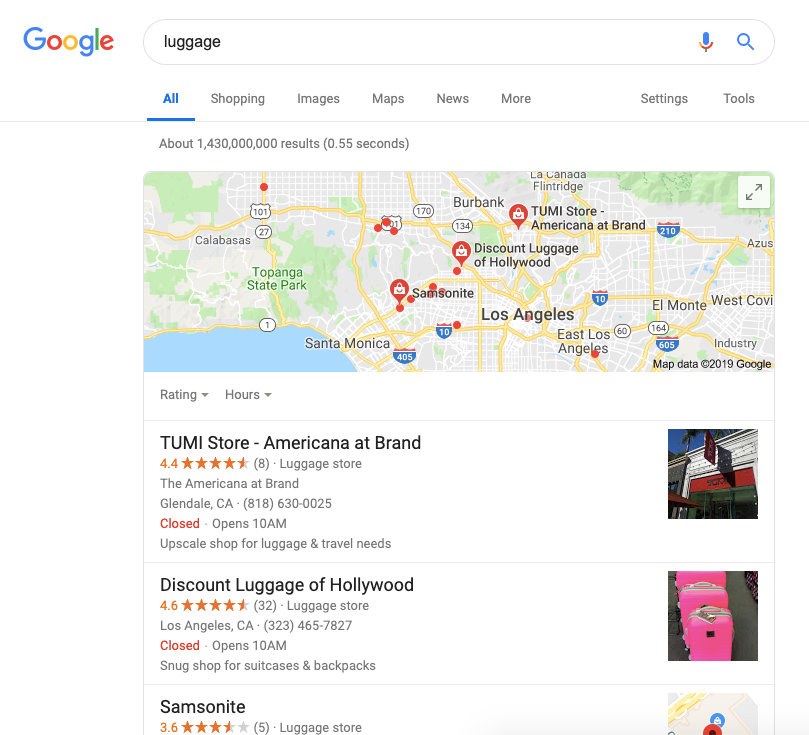

Some search queries related to luggage, suitcases or different brands trigger the map box, which shows local results.

This shows the local, reseller network that many of the other brands capitalize on. It will be interesting to see if Away can make inroads into this by expanding to their own physical locations.

Branded paid search

Branded clicks are about 30% of total paid search traffic, which means about 12,000 visitors.

Top 10 branded keywords

| Keyword | Monthly searches | CPC |

| away luggage | 74,000 | $0.78 |

| away | 22,200 | $0.49 |

| away travel | 22,200 | $0.32 |

| away suitcase | 9,900 | $0.72 |

| away luggage review | 5,400 | $0.75 |

| awaytravel com | 3,600 | $0.21 |

| away luggage promo code | 2,900 | $1.91 |

| away carry on | 2,900 | $0.94 |

| away bag | 1,900 | $0.59 |

| away travel luggage | 1,300 | $0.76 |

Source: Semrush

What’s interesting from this list is the difference in cost per click between the pure branded keywords and those that include the generics like suitcase or luggage.

Getting a click on the “away” keyword costs $0.49 per click and “away travel” costs $0.32 per click. While away carry on costs $0.94 per click.

That’s a pretty big gap.

So when we look at it from a PPC perspective, their domain choice was a good one. Awaytravel.com is pretty cheap while awayluggage.com would probably cost them 4-5X the amount.

Their strong affiliate program is reflected in the cost per click of “away luggage promo code”. At $1.91, it’s clear that there are a lot of affiliates that want to get that click.

Search Ads

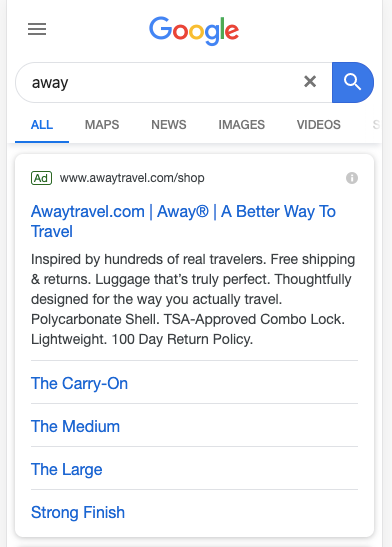

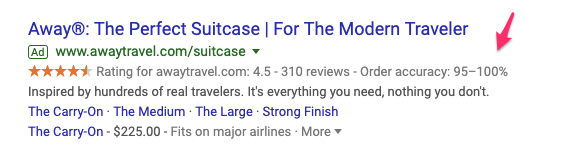

I’ve looked at a wide variety of Away’s ads that pop up for branded keywords.

All of them are pretty good. A strong focus on the brand name with some other brand elements like “A Better Way To Travel” or “For the Modern Traveler”.

The actual ad text contains a little extra info with some Sales Boosters sprinkled throughout: “100 Day Return Policy”, “Free shipping & returns”.

They are also using the ® hack to increase CTR, a trick that often works.

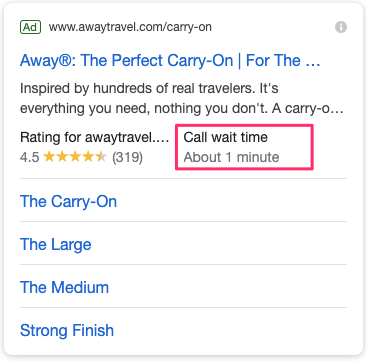

Besides the ad, they are using all ad extensions: everything from sitelinks, callouts, structured snippets, seller ratings, and even a new type of call extensions.

Landing page

All of these searches point to their general products page with suitcases, bags, and others.

Non-branded paid search

As I’ve mentioned before, Away is the market leader (in the US). This means they have a higher brand awareness which leads to a higher ad clickthrough rate.

Which, in turn, leads to a lower cost per click and a better return, especially when it comes to unbranded searches.

This is where most of the volume (and growth potential) lies for most advertisers. But it’s hard to capture these searches profitably.

In Away’s case, unbranded paid searches account for 70% of all clicks, about 28,000 per month.

Top 15 unbranded keywords

| Keyword | Monthly searches | CPC |

| luggage | 165,000 | $2.18 |

| carry on luggage | 90,500 | $1.94 |

| suitcase | 90,500 | $1.86 |

| luggage sets | 74,000 | $1.98 |

| samsonite luggage | 49,500 | $2.01 |

| tumi luggage | 22,200 | $1.24 |

| carry on | 22,200 | $1.93 |

| best carry on luggage | 22,200 | $1.81 |

| luggage sale | 18,100 | $2.10 |

| kids luggage | 18,100 | $1.65 |

| best luggage | 14,800 | $1.27 |

| kids luggage | 14,800 | $1.22 |

Source: Semrush

Looking at this top 15, a few things stand out already.

First that they are advertising on the biggest keywords of the industry luggage and suitcase.

Luggage gets 165,000 searches a month and cost over $2.18/click. Suitcase gets 90,500 searches a month, at $1.86/click. Carry on luggage is a bit more specific but still gets 90,500 searches a month at $1.94/click.

The huge volume combined with the high cost per click makes this a very interesting challenge.

I didn’t see a lot of other competitors in the search results advertising on the same keywords, or not as aggressive as Away is. Which probably means the economics of smaller players don’t allow them to advertise on these massive terms.

The second observation is the ads on competitor searches like Samsonite, Tumi, and Rimowa (just outside this list). They don’t seem to do anything special to capture these competitor searches. So for them, it’s probably more about visibility next to the competition.

I haven’t been able to replicate these competitor ads in my own tests. This could mean these type of searches are geographically limited. Or that they only run them during a specific season.

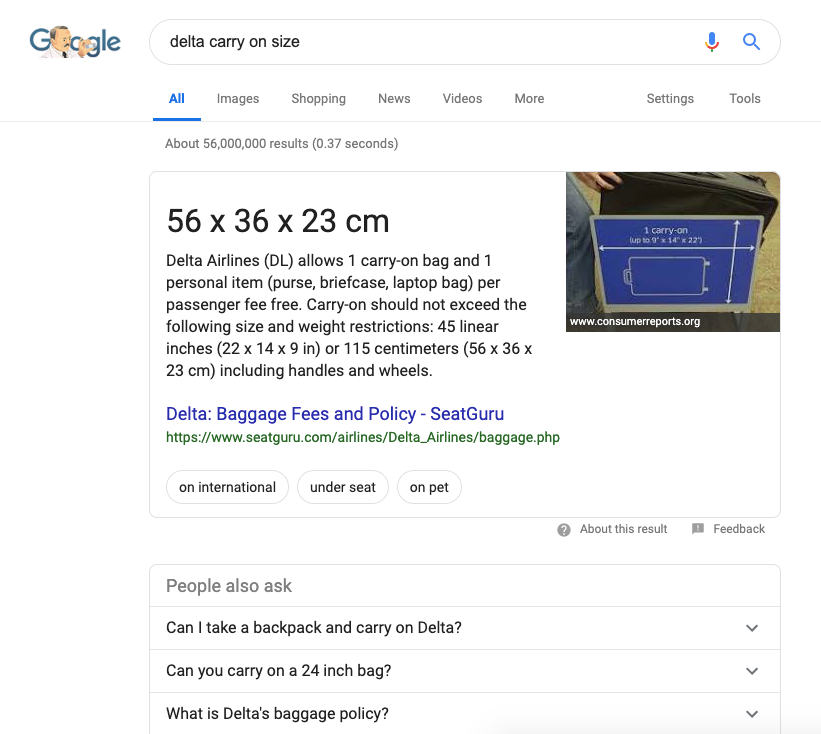

A third interesting finding is that Away was targeting people that want to check the dimensions that they can bring on board:

- delta carry on size

- united carry on size

- spirit airlines carry on

- jetblue carry on size

These type of searches usually trigger an answer box:

Again, I couldn’t replicate this and find ads on these search queries, but Away has run ads to these keywords in the past.

My guess is that these clicks weren’t profitable. Only a very small percentage of people searching for these terms might realize that their bag doesn’t fit those dimensions and purchase a new one.

So they should take a close look at their keywords and make sure the match types are tightened up.

Search Advertisements

The search ads Away uses for the unbranded searches are very similar to the ones for branded traffic.

Unbreakable & Lightweight Ad

Thoughtfully Designed Ad

Here is an ad they were showing for searches to premium brands (eg. prada luggage), highlighting the “first class luggage”

All ads make good use of all ad extensions I especially like that last price extension of the ad below. In its description text, it has “Fits on major airlines”, a concern that many buyers might have.

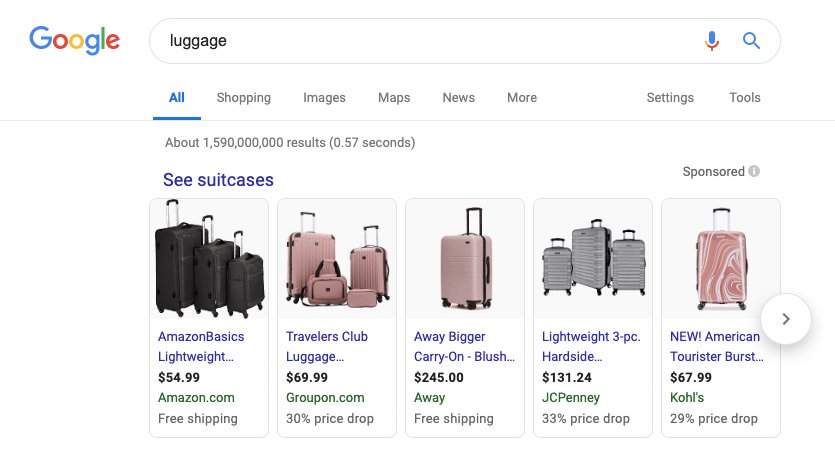

Google Shopping Ads

For the 40,000 visitors that Away gets from Google Shopping ads, let’s assume a similar split: 30/70 brand and non-branded search queries.

Before we get down to the keywords and ads, there is an important thing I noticed doing research on Away’s Shopping ads.

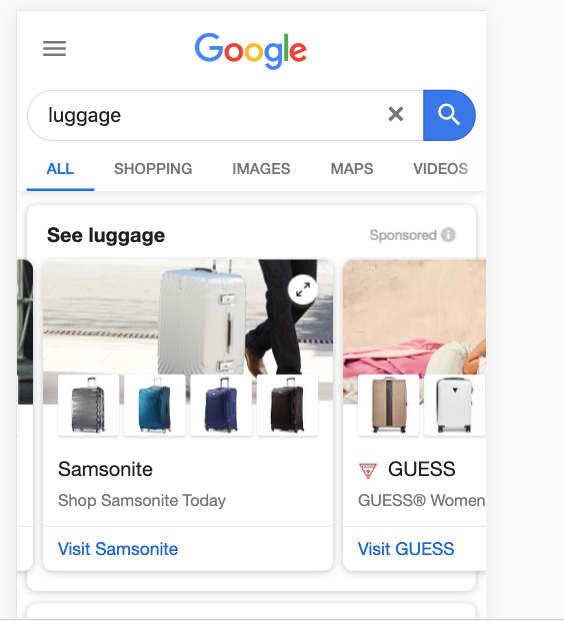

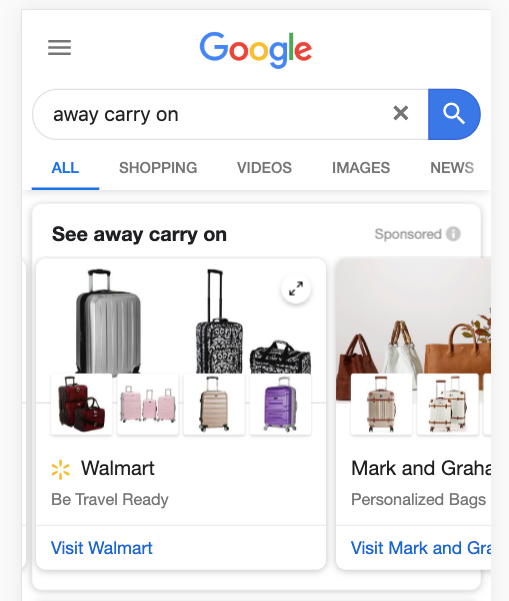

They are only running regular Product Ads. There are the most common. But in late 2018, Google added another type of Shopping ads, Showcase Shopping Ads.

In Away’s market, this ad type comes up a lot on mobile searches. Like this search for “luggage”:

Instead of the products ads, you see tiles of the different vendors that are clickable. After a click, you’re taken to a list of product ads.

Away isn’t running this type of ads, so anytime Google decides to show them, they lose visibility to their competitors.

I managed to replicate the above screenshots for top keywords like suitcases and carry on luggage.

I even tracked down a set of ads that appeared on brand searches:

A field day for competitors like Ebags, Kohls, Samsonite, and Walmart.

With that out of the way, let’s look at the Shopping Ads they are running!

Keywords

We can see that Away is running ads on similar search queries to their Search Ads.

Branded keywords:

- Away travel

- Away

- Away luggage

- Away carry on

Some unbranded ones:

- luggage

- suitcase

- carry on luggage size

I also found some AIRLINE + DIMENSIONS searches being matched with Shopping ads. Away would be smart to dig deeper and look at the performance of these queries.

Also similar to Search, are the competitor searches like Tumi or Rimowa.

The product focus of Shopping campaigns brings an interesting question to these competitive searches.

Away’s basic carry on suitcases is in the $250 range and their higher priced aluminum editions are in the $500 price range.

The market is clearly segmented on price points as well. I’d say that $245 is already at the upper end of the basic tier. Amazon’s own brand sells for $55:

Then you have higher priced brands like Tumi:

And at the top end of the market there are brands like Rimowa that sell for more than $1,000:

So if Away wants to compete effectively with these brands, they should use their product line-up to their advantage.

Searches queries for premium competitors should be blanketed with their higher price point products.

This can be done by using different campaigns with custom labels.

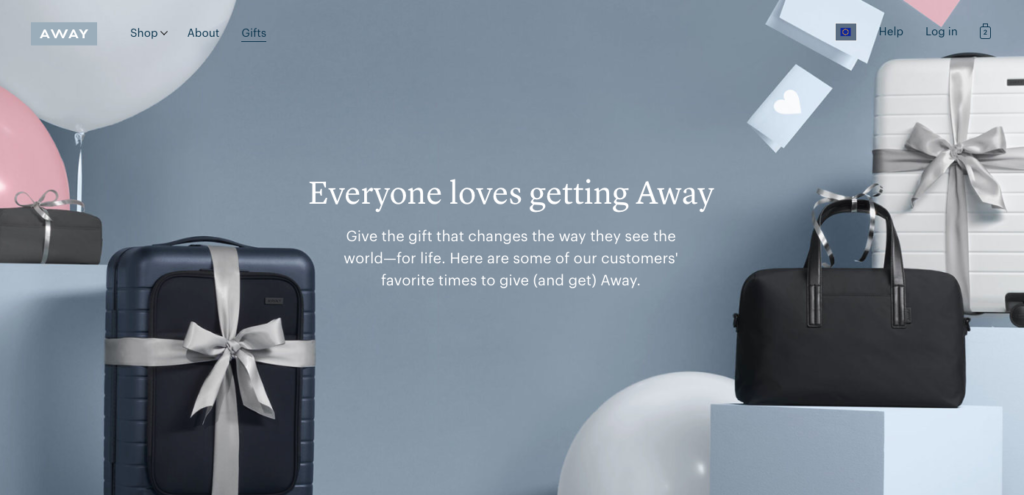

YouTube Video Ads

Away didn’t run any YouTube ads when I was researching them.

Exploring the Away YouTube channel, they only have 668 subscribers (which is just a tad over the Store Growers YouTube channel, which you should subscribe to!).

Still, some of their most popular videos have over a million views. That smells like ads.

Here is a campaign they ran during the 2018 holiday season:

The content of these ads (Christmassy feel) and offer on the landing page (gift focused, see below) probably indicates that this is the time of the year when people buy luggage for others. While throughout the year it is something people buy for themselves.

This probably means that they invest in video campaigns, around the times when people are likely to purchase luggage.

And while their YouTube testing isn’t as sophisticated as the likes of Purple Mattresses, you can see in the channel some results from their experiments.

All 4 videos uploaded at the same time, with a similar concept. You can see two winners emerging (the ones with 802k & 1.6M views 😮)

These are very well produced clips which also makes them suitable to run as TV commercials. This is something they have done in the past.

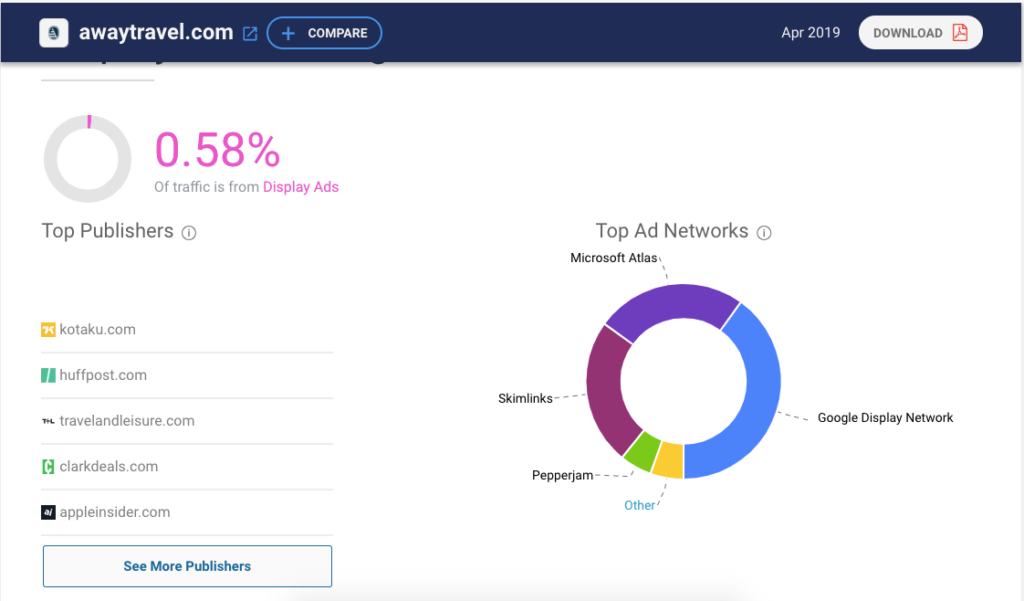

Google Display Ads

According to Similarweb, about 0.58% of Away’s website traffic comes from Display advertising, and about a third of that comes through the Google Display network.

This works out to about 6,000 clicks a month at a cost of $2,160.

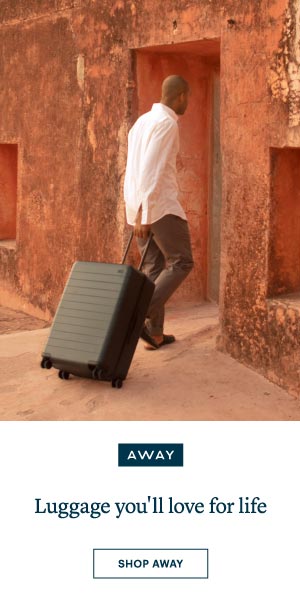

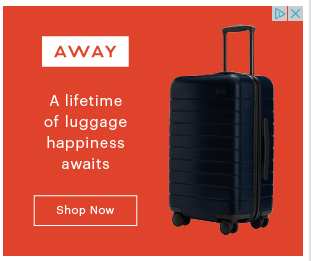

In my research, I mainly found remarketing campaigns:

This ad doesn’t just sell the luggage, it also sells the feeling of traveling to exotic places.

Another more straight to the point ad:

Both stress the lifetime warranty that Away offers, a guarantee that might pull a few potential customers back to the site to complete their purchase.

One thing they don’t seem to be doing is sending product data to Google to enable dynamic remarketing.

These are ads that feature the actual product a visitor was looking at, mixed in with a couple of others.

The default Responsive Ads that Google creates are pretty bland. But with the design chops Away has on their team, they should be able to put together something nice and simple.

Like the one Allbirds uses:

On Facebook Away is running Dynamic Product Ads:

So while it seems like they’re not running this type of ads, it could be that they’ve experimented with it in the past.

If they haven’t, that’s one of the first things I’d try out.

The Away Scoreboard

Money time 🤑

The Scoreboard is the part where we pull together all the research to look at how much money Away is making (or losing) with their Google Ads campaigns.

Gross margin

Away sells direct to consumer, compared to other retailers like Samsonites which sells the bulk of its products to resellers. This should result in higher gross margins for Away.

So while Samsonite reported a gross margin of 57% in 2017, Away is probably closer to 60-70%. Let’s be conservative and keep it at 60%.

Average order value

Rakuten research puts the AOV at $244.59.

This is in line with a self-reported number of making $150 million by selling 500,000 suitcases. (Which puts the AOV at $300)

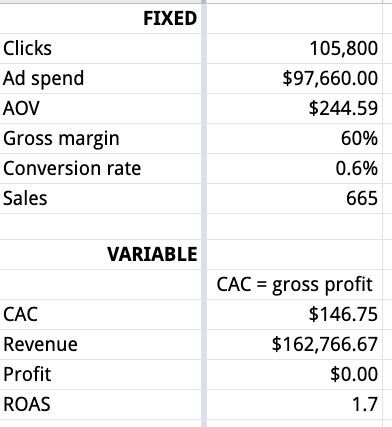

If we plug in these metrics, we can see what kind of revenue Away would do if their customer acquisition cost equaled their gross profit:

Now if we start improving their acquisition strategy (and lowering the CAC), the numbers start to improve:

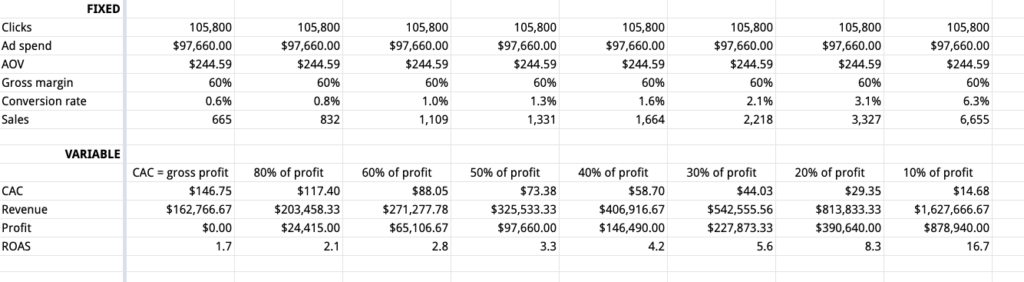

Paid search contributed to about 10% of traffic. If we consider an annual run rate of $150M and calculate the contribution of paid search we come at 15M / year.

On a monthly basis that is 1.25M. To get closer to that Away needs to achieve a very low customer acquisition cost. So in what follows, let’s assume they spend 20% of their profits on advertising. That means they make $8.3 for every dollar they put into ads. To hit this they would need to hit a conversion rate of 3.1%, which is high but possible.

Let’s use these metrics to continue to build our model.

Repeat purchase rate

The nature of Away’s products doesn’t lend itself to a lot of repeat purchases. Someone might buy a checked bag and a carry-on.

Founder Stephanie Korey is well aware of this:

One thing we are very intentional about is building a product and marketing system that allowed us to be profitable on the very first order. So, for us, it didn’t matter if the customer was ever going to come back and buy something else from us. That was something we very intentionally built as the financial foundation of this business.

But in their latest funding round, they explicitly stated a product portfolio expansion as one of the next goals. These will probably continue the trend of adding products like toiletry and packing bags.

Here is the other Away co-founder, Jen Rubio:

When someone’s going on a trip, we want to make everything that they need to go on on that trip.

So if we add in some repeat purchases, varying the repeat purchase rate from 0% (customers only buy once) to 30% (30% of customers purchase again at the same AOV without any additional marketing expenses).

As you can see, getting repeat purchases really opens the profit faucet. So it’s obvious why they are spending a lot of time to get this last part right.

Takeaways

The Scoreboard shows that thanks to their direct to consumer business model, their margins allow a lot of room to advertise aggressively. Their position as a market leader gives them high brand awareness. This combo allows Away to be a lot more productive with every dollar put into marketing.

If they can back that up with a cost structure that mimics other big players in the market AND crack the code on additional purchases, I can see this brand being around for a long time.

Got questions or things I didn’t cover, let me know in the comments!

Read our other breakdowns: Purple – MVMT – Judy – Allbirds – Glossier – Ritual – Caraway – FIGS