Being good at Google Ads doesn’t mean that you can run and scale profitable campaigns.

That might sound weird. But it is true. And the reason I know this is because I’ve failed at it plenty of times.

Sometimes it was because the business wasn’t ready to run ads, sometimes it was because I was lacking in some other area.

This article is about the last part.

Because in ecommerce, your products are the number one thing.

And knowing more about them, and leveraging that knowledge, adds something that I call “Product IQ” to your campaigns.

It took me a couple of years but once I understood how powerful this was, I paid close attention to it.

So in this article, I’ll show you what Product IQ is and how to use it to achieve better results.

Table of Contents

What is Product IQ

To serve a business most effectively you need to understand its flow.

Which products drive sales? Which products drive first-time purchases? What’s your back catalog of products you can use to drive repeat orders?

Take for example Best Buy, which often runs promotions that sell products at cost.

Best Buy Black Friday promotions for low(no) margin products

If you buy one of those TVs, they probably don’t make any profit. But they make up for it by selling you extra cables and or extended warranty.

So if you just focused your Google Ads campaigns on achieving maximum profitability, you won’t put any budget behind a product that literally has no margin.

But taking a step back and looking at the overall strategy, it does make sense to advertise hard on these products. You lure in buyers with a loss leader and then upsell higher-margin products.

My goal with this example isn’t to convince you to start selling products at cost. I do want to illustrate how getting more clarity about the products in your catalog and being intentional about how to promote them can yield results.

Why should you care?

Without Product IQ, every product is considered equal and Google Ads campaigns are optimized based on metrics like click-through rate and conversions.

If you are the business owner and you’re running your own campaigns, you have a lot of built-up knowledge about which products you want to sell more of.

But if a freelancer, consultant or agency runs your ads, their focus will be on bringing the traffic and sales, without much regard for the products. It’s obvious why this happens, it takes time and intention at the start to figure these things out.

But the truth is that most businesses don’t want to traffic, they want the sales that come with that traffic.

So if you run Google Ads for a client, adding Product IQ to your toolbox allows you to make your clients happier.

Before I show you how to do it, let me show a case study of applying Product IQ to my clients’ campaigns.

Adding Product IQ (Client Case Study)

First a little background on the business I was working with: established ecommerce operation (> 5 years), doing high 6 figures a year in ecommerce sales, solid base or repeat customers, strong organic presence, a bit of email marketing and Google Ads campaigns that were running on autopilot.

They brought me in to help with that last part because they felt their Google Ads campaigns were underperforming.

They had over 2,000 products. So when we started working together, I knew I had to get my Product IQ up. So I asked them for their purchase data:

- how much were each brand, product, and category selling

- what did their margins look like

(In the next section I outline the exact reports to ask and look for).

I used these reports, together with things like keyword research, and overhauled some of the campaigns which I expected to perform well.

Getting these campaigns in place and optimizing them with the additional product info gave a 10% boost in revenue, a steady ROAS but a 25% jump in profits during the two months of working together.

Together with running these campaigns, there were also a couple of catch-all campaigns. The goal of these was to bring in additional traffic and spot some more interesting items.

When I saw products and brands doing well in these campaigns, I pulled them out into their own campaigns and started putting more budget behind them.

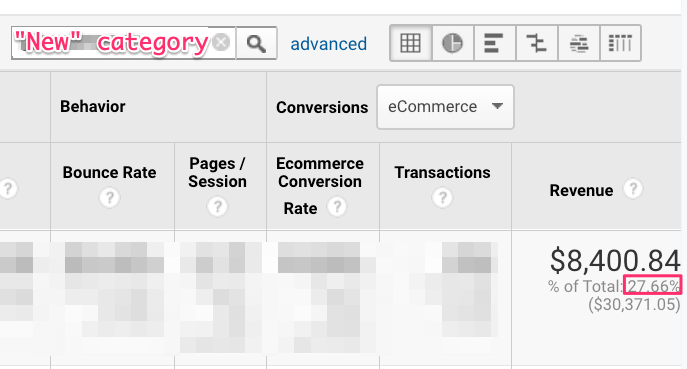

This led to a boost in sales of a category that was previously not doing much. Today it is the strongest category, responsible for about a third of all revenue from Google Ads!

The reason for this blind spot is that this specific category didn’t have strong organic rankings. So because these products and category pages were ranking on page 2-3, not many sales came in, despite having solid pricing.

Read on to find out how exactly you can do this for the campaigns you manage.

Applying Product IQ To Your Campaigns

It’s clear that there is a big gap between being completely clueless about a product category to having an intuitive feel if you’re selling the right things.

There are a ton of different systems and reports you can collect and analyze. But starting out, not all that information is essential.

That’s why I’ve divided it up into a couple of different stages. Read through the whole article, but implement it stage by stage. That will prevent you from getting stuck with loads of different spreadsheets, without any clue how to act on them.

Stage 1: Focus on what’s working

This first stage is pretty straightforward. You find out what has been working, and you try to do more of that.

You have a couple of different sources to get this information.

Data source 1: Ecommerce back-end

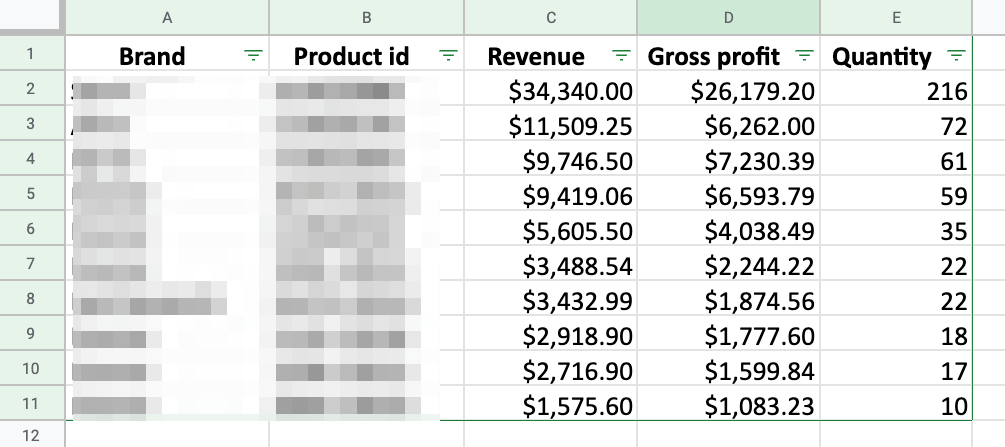

These reports will vary depending on the system you’re using, and the data available in them. Great reports are those that break down the sales, units sold and profit by brand and product.

Here is an example of such a report:

A report like the one above will give you a pretty good idea of what’s selling well. The downside of most of these exports is that they are is missing the source of the sale.

For that, we can use Google Analytics has an answer for that

Data source 2: Google Analytics Enhanced Ecommerce

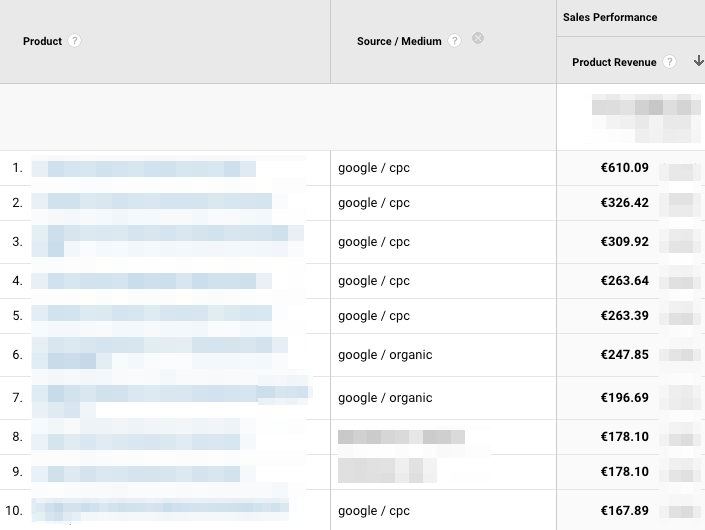

Here is the Product Performance Report, broken down by source/medium:

You can find this report in your own Google Analytics account: Conversions > Ecommerce > Product performance. Then add “Source / Medium” as secondary dimension.

It’s not that useful in Google Analytics so I usually export it to Google Sheets.

There it’s easier to drill down, add additional columns, or run some calculations.

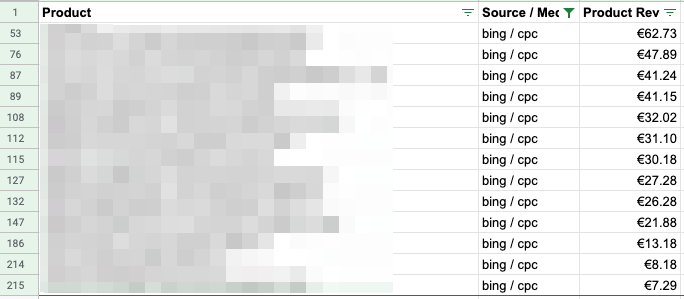

Here are for example the products that are selling well on Bing Ads:

Two comments about working with these kinds of reports:

- Time period: pull these reports at least for the last 3 months or maybe even a year

- Identify seasonality: don’t assume that the last 3 months worth of data is representative for the whole year. If you’re not sure, the best way is to ask your client or someone a colleague about this.

Now that you have a ton of data, let’s see what we can do with it.

First, you get a feel for what is selling well in general:

- Top products by revenue – overall

- Top products by units sold – overall

Next, you drill down into those reports and figure out what’s selling well organically, and what’s selling well via your advertising campaigns.

A product that sells well organically has a pretty good chance of selling well with the right campaigns behind it.

But there are exceptions though. With SEO, you don’t always know which search queries are driving the sales. So if you’re ranking very well organically for a branded keyword, putting that product in a Google Shopping campaign, might attract a ton of generic searches and doesn’t produce any sales.

The reason I mainly look at organic vs paid search is that other channels are a bit trickier to compare. A referral link sending traffic can lead to a lot of targeted sales of a specific product. If you try to push traffic to that product in your campaigns, that might fall flat.

Depending on what you’re spending on each channel, it might be valuable to look even deeper into the difference between Google Ads and Bing Ads for example.

If you’re using Google Shopping, custom labels are key in adding this Product IQ to your product feed.

Objectives for stage 1:

- Understand which products are generating the most revenue/profit/sales (think 80/20)

- Focus the bulk of your budget on Search and Shopping campaigns pushing those products

Stage 2: Find hidden potential

In this stage, you’ll try to uncover what’s missing from the reports you’ve seen in the first stage.

To do that, you need a little more insight. If you’re working with a client or team, this again is very valuable to talk with them. (This will also give you a bunch of credit since few outsiders bother to get to know their business).

Data source 1: Client or team

These are the things you want to know:

- Breakdown of margins by brand / brand+category / brand+product

- What used to sell well but doesn’t anymore?

- Which products are selling below expectations?

The goal is for them to share some of their product knowledge with you.

Data source 2: Suppliers

Another great source of insights can come from a supplier or wholesaler.

With one client I worked with, one of their suppliers provided a ranked list of products and how well they were selling:

That same wholesaler also shared with us how many units an “undisclosed competitor” was selling.

This was absolute gold as it helped to uncover some hidden potential.

Because once we knew what volumes a competitor was selling of which products, we started testing to replicate those volumes.

At first, it was a little scary because we were spending quite heavily on products that had not produced much for us in the past. But armed with the knowledge that a competitor made it work, we kept putting more budget behind it and tweaking the campaigns.

After a couple of weeks, we started to see a nice uptick in sales that we would have missed if we didn’t have that information. All we had to do is ask.

If you don’t have access to a team or helpful vendor, there are other options.

Data source 3: Catch-All Google Ads campaigns

A good alternative at that point is to run a couple of catch-all campaigns for your product catalog. In Shopping these would have all of the products that you haven’t broken out into their own campaigns. In Search, you could run a Dynamic Search Ads campaigns to those same products.

You keep your bids low and monitor which products are doing well. You slightly increase those, and if the trend continues, break them out into their own campaigns to have full control.

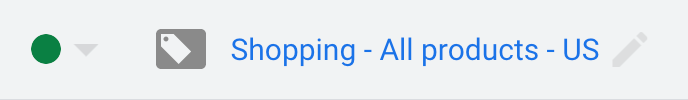

Data source 4: Google Ads Auction Insights Reports

Another good source to find interesting products to push harder is the Auction Insights reports.

Find this report in your Google Ads account by going to a Campaign or Ad group > and click the Auction Insights tab right above the line chart.

This report will list the competitors that are bidding on the same keywords/products then you are.

The main thing to look for is shifts in spending. If you see a competitor with a 30% Search impression Share goto 90% IS a month later, it might be worth looking into why this is happening.

If you have your account well organized, you’ll be able to monitor these trends for specific categories, brands or products.

When you find such a shift, have a look at their websites to see if they added any new products or brands that might have caused an increase in spending.

Objectives for stage 2:

- Find products that aren’t living up to their potential

- Expose these products to more traffic

Stage 3: Identify growth opportunities

During the first stage, we capitalized on what was already working. In the second stage, we tried to get more from that same product catalog.

At this stage, the goal is product expansion: identify new products or brands that could be interesting.

If you’ve been hired to manage the Google Ads, sourcing new products is a bit outside of your job responsibility.

But that doesn’t mean you can’t contribute and help someone else do their job better, and reap the benefits from having a better product catalog to push with your ads.

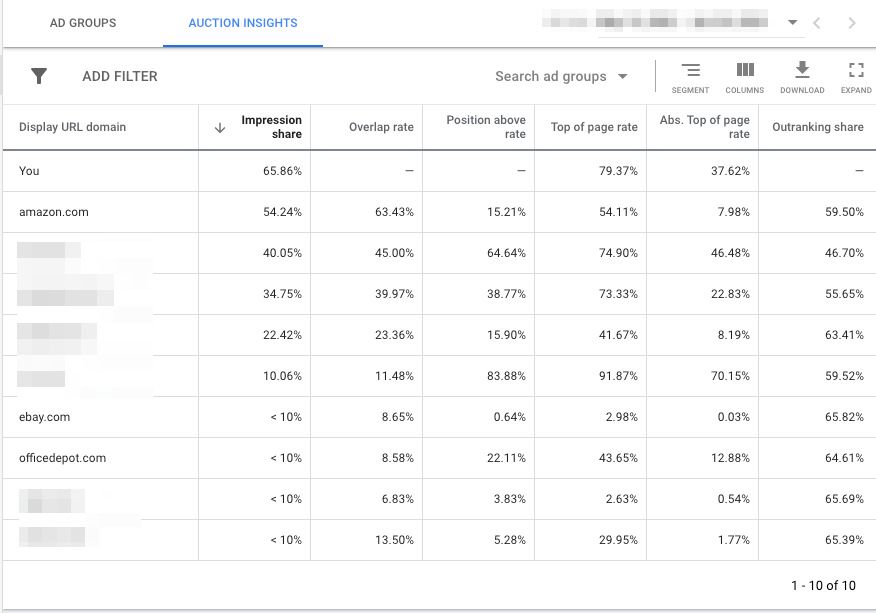

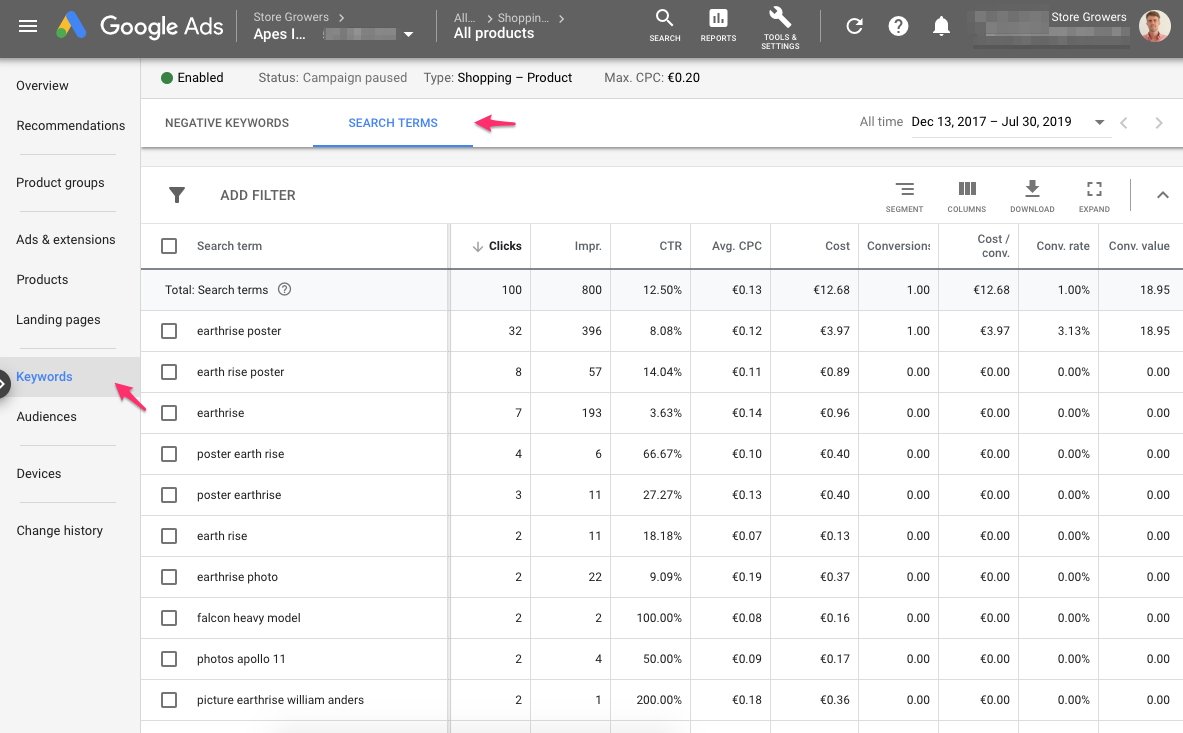

Data source 1: Google Ads Search Terms Report

If you’re managing Google Ads campaigns, you spend a lot of time looking at the search queries that come in.

Look for interesting new products in the Search Terms Report

Usually, you do this to filter out poor matches and get ideas to further develop your campaigns.

But instead of always excluding search queries for products or brands you don’t sell, you could view these as an ongoing product research tool.

I will often take note of new products or brands popping up. I keep these in a list and occasionally share these with the client to discuss.

They are not always relevant, but in a few cases, I’ve helped to bring in a new brand or product that was a nice addition to their catalog.

Data source 2: Your competitors’ website

This one is pretty straightforward. From the previous stage, you’ll have a pretty good idea of which sites are competing with your ads.

Get to know your competitors’ product lines, figure out which brands or products they are pushing.

See if they have a “New arrivals” or New products sections. Or sign up for their newsletter to discover new additions to the catalog.

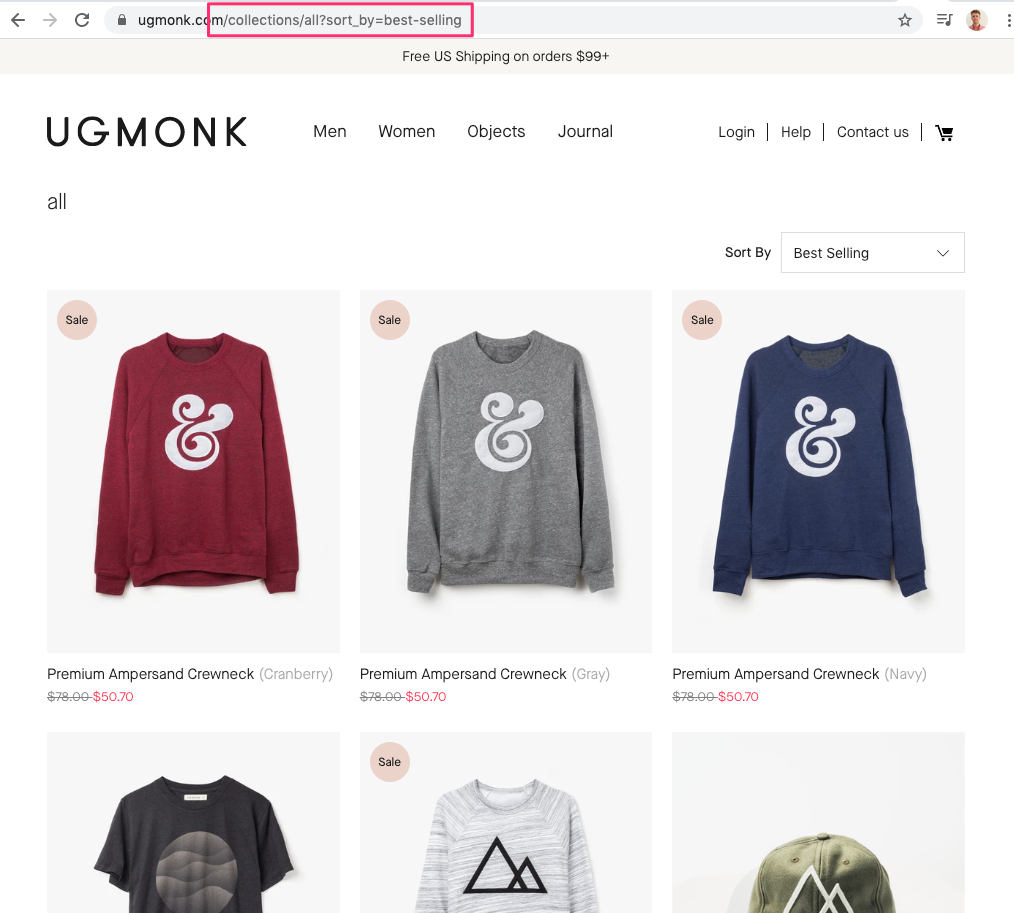

If they are on Shopify, just add collections/all?sort_by=best-selling behind the URL. That will show you the top products for this site. Here are for example the best selling products of Ugmonk:

Trick to identify the best selling products on Shopify hosted stores

Product IQ Beyond Google Ads

The goal of Product IQ is to make you a more effective ecommerce advertiser. But these insights can be leveraged far beyond Google Ads.

To finish off, I want to give you some ideas you can pursue, or share with your clients

In Website Design

Once you figure out which products matter most, it’s time to take another look at your site.

Use these questions to spark some thoughts:

- Which products do you feature on your homepage? On your category pages?

- Which products do you push hard via related products?

It’s hard to keep track of the effectiveness of all of these little things.

But if you know that product A sells twice as many units as product B, why not push the former?

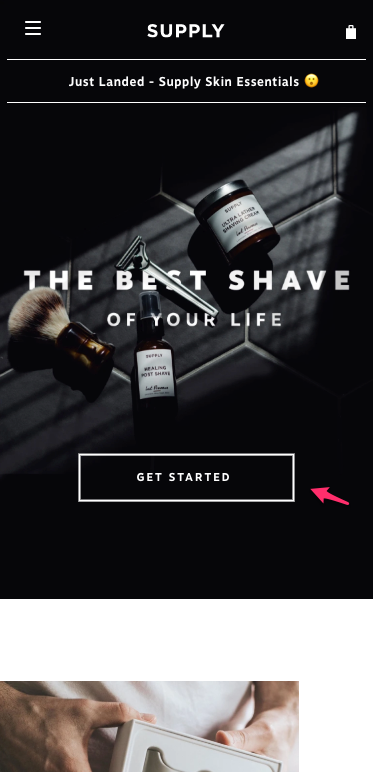

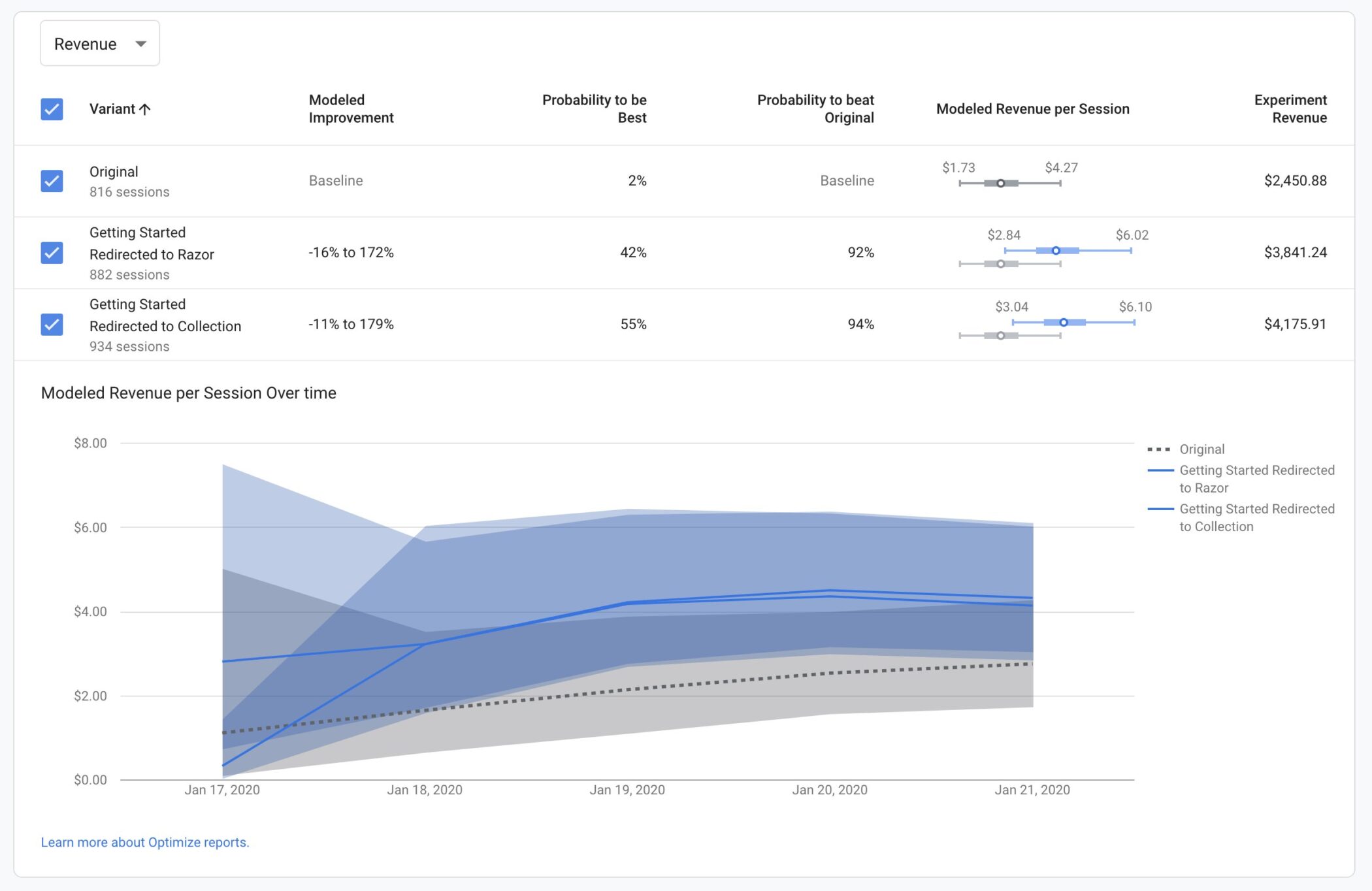

I recently came across this example from shaving company Supply. They ran a test of where they linked their homepage’s Hero button.

Homepage of Supply.co

Instead of pointing it to their starting set, they started testing a couple of alternatives:

Screenshot of a Google Optimize test from Supply – Source

The test is still ongoing, but it’s these kinds of experiments that can deliver small gains.

On Landing Pages

If you’re targeting generic traffic, you could send these visitors to your category pages

Another option is to create landing pages for specific searches that really provide a lot of value.

You could highlight your cheapest product or the most popular products.

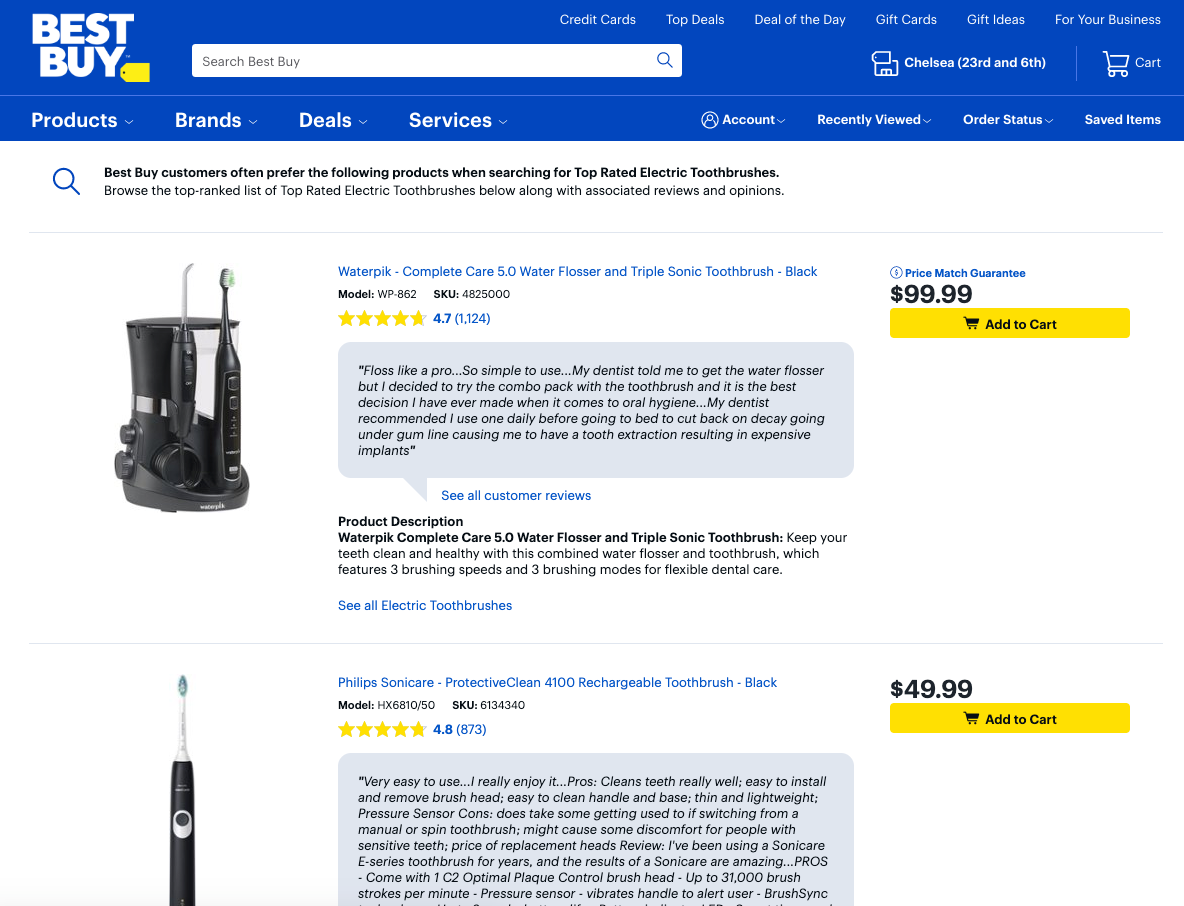

A good illustration of this is the following landing/category page from Best Buy if you search for “best electric toothbrush”.

Example of a content-heavy category page from Best Buy

The more they know about which products perform better, the more effective they can make a page like this.

In Email Marketing

Another HUGE topic is how to leverage your Product IQ with email marketing.

The simplest question of that is: Which products do you feature in your newsletter?

Think about the companies that used to send out these huge catalogs in the mail. They would spend a ton of money sending them out. So every product had to prove its value in the tests running up to the big push.

You probably don’t have the time (or data) to go over every part of your email. But just being a bit more thoughtful might go a long way.

If your store has been around for a while, there are a ton of additional things you can discover.

For example:

- Which products to first-time buyers purchase?

- Which products sell well with repeat customers?

Is there anything you can do to influence this?

These are very interesting dynamics to discover that can pay huge dividends.

If you want to dive deeper into these, take a look at this advanced email marketing case study. It will make your head explode with ideas!

Using Product IQ

The goal of this article was to highlight the benefit of product knowledge in marketing.

By understanding what products to focus on, your efforts will be a little easier and investments will see a better return.

Becoming smarter about the products you are advertising doesn’t happen overnight. There are a couple of stages most advertisers go through:

- Strengthen the existing best-sellers

- Maximize the potential of the product catalog

- Product expansion for future growth

While this article focused on applying Product IQ to Google Ads, there are plenty of other ways to benefit from these insights.